Testing Model Assumptions: Residual Analysis

Assumptions Concerning the Error Term [1]¶

In this section, we will focus on the error term . The distribution of the regression coefficients depends on the distribution of the error term . The distribution of the error term hence determines to which level our model predictions are correct. In this section, we assume that

where the function is assumed to be known. In practice, this is never the case. To focus on the assumptions concerning the error term , we will consider rather simple functions .

What is the meaning of ?

If we measure at position , then the following equation

holds, where represents the error of the function at position , or to be more concise: it represents the deviation of the measured value from the predicted value of . If we repeat the measurement several times at the same position , we will observe for every measurement a different value of due to the error term .

Statistic [2]¶

The RSE provides an absolute measure of lack of fit of the linear regression model

to the data. But since it is measured in the units of , it is not always clear what constitutes a good RSE. The statistic provides an alternative measure of fit. It takes the form of a proportion—the proportion of variance explained—and so it always takes on a value between 0 and 1, and is independent of the scale of .

To calculate , we use the formula

where is the total sum of squares and is the residual sum of squares. TSS measures the total variance in the response , and can be thought of as the amount of variability inherent in the response before the regression is performed. In contrast, RSS measures the amount of variability that is left unexplained after performing the regression.

If the model fits the data perfectly, then we have for . In this case, the RSS becomes 0, and hence . As a consequence, an value of approximately 1 means that a large part of the variance in the data is explained by the model. Conversely, an value near 0 indicates that little of the variance in the data is explained by the model. This might occur because the linear model is wrong, or the inherent error is high, or both.

Source

import numpy as np

import statsmodels.api as sm

# Set random seed

np.random.seed(0)

# Create Random data allong y = x^2 + 4

x = np.arange(-4, 2.4, .4)

y = -(x * x) + 4 + np.random.normal(0, 2, len(x))

# Fit Linear Model

x_sm = sm.add_constant(x)

model = sm.OLS(y,x_sm).fit()

# Print Model Summary

print(model.summary()) OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.516

Model: OLS Adj. R-squared: 0.481

Method: Least Squares F-statistic: 14.91

Date: Mon, 03 Nov 2025 Prob (F-statistic): 0.00173

Time: 16:42:42 Log-Likelihood: -40.363

No. Observations: 16 AIC: 84.73

Df Residuals: 14 BIC: 86.27

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 2.6174 0.917 2.855 0.013 0.651 4.584

x1 1.6876 0.437 3.861 0.002 0.750 2.625

==============================================================================

Omnibus: 3.331 Durbin-Watson: 0.690

Prob(Omnibus): 0.189 Jarque-Bera (JB): 1.592

Skew: -0.447 Prob(JB): 0.451

Kurtosis: 1.740 Cond. No. 2.53

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The value is .

[4]¶

The linear model assumes that there is a straight-line relationship between the predictor and the response. If the true relationship is far from linear, then virtually all of the conclusions that we draw from the fit are suspect. In addition, the prediction accuracy of the model can be significantly reduced.

Residual plots are a useful graphical tool for identifying non-linearity of the regression function . Given a simple linear regression model, we can plot the residuals versus the fitted or predicted values . We thus plot the points for . The resulting plot is named Tukey–Anscombe-Plot after its inventors.

Tukey–Anscombe-Plots [5]¶

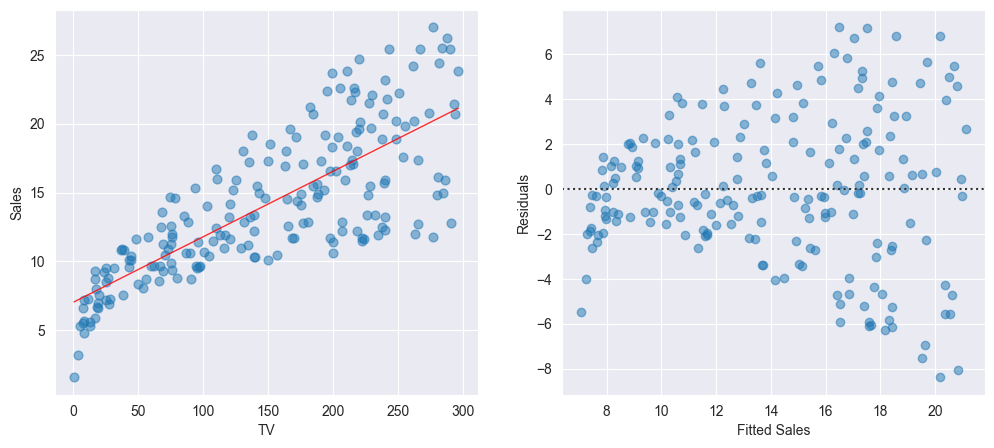

On the left-hand panel of the Figure the scatter plot for the Advertising data set is displayed. The right-hand panel displays the corresponding Tukey-Anscombe plot.

Source

import pandas as pd

import statsmodels.api as sm

import matplotlib.pyplot as plt

import seaborn as sns

# Load data

df = pd.read_csv('data/Advertising.csv')

x = df['TV']

y = df['sales']

""" Find Predictions and Residuals """

# Fit Linear Model

x_sm = sm.add_constant(x)

model = sm.OLS(y, x_sm).fit()

# Find the predicted values for the original design.

yfit = model.fittedvalues

# Predict values based on the fit.

ypred = model.predict(x_sm)

# Residuals of the model

res = model.resid

""" Plots """

# Create figure and subplots

fig = plt.figure(figsize=(12, 5))

ax1 = fig.add_subplot(121)

# Plot data and regression

sns.regplot(x=x, y=y,

scatter=True, ci=False, lowess=False,

scatter_kws={'s': 40, 'alpha': 0.5},

line_kws={'color': 'red', 'lw': 1, 'alpha': 0.8})

# Set Labels

ax1.set_xlabel('TV')

ax1.set_ylabel('Sales')

# Plot Residuals

ax2 = fig.add_subplot(122)

df = pd.concat([yfit, res], axis=1)

sns.residplot(x=yfit, y=res, data=df,

lowess=False, scatter_kws={'alpha': 0.5})

ax2.set_xlabel('Fitted Sales')

ax2.set_ylabel('Residuals')

# Show plots

plt.show()

We observe that the regression line on the left-hand panel corresponds to the horizontal axis on the right-hand panel of the Figure. We now can easily read off the values of the residuals for every predicted value .

The linear model fits the data well if the points in the Tukey-Anscombe plot scatter evenly around the line. “Evenly distributed” means, that within a small area of the line there are approximately as many points above the line as there are points below the line. These points should ideally have the same distance from the line. In other words, in such an area for the average of the residuals

should hold. Since we are estimating the error terms by means of the residuals, this relation finally is equivalent to the model assumption .

Smoothing Approach [6]¶

How can we decide on the basis of the Tukey-Anscombe plot whether the model assumption is fulfilled? To visualize the relation between the residuals and the predicted response values , we will take advantage of the smoothing approach.

In the following, we will roughly illustrate the principle of the smoothing approach. A simple yet intuitive smoother is the running mean. It involves taking a fixed window width on the -axis, and compute the mean of the -values of all the observations that fall into this window. This value then is the estimate for the function value at the window center. The left-hand panel of the Figure below displays two thin stripes : the average of all residuals falling into such a stripe is calculated and is plotted as a red point at the center of the corresponding stripe. If the stripes are sliding along the -axis, connecting the red points for every window position then results in the red curve displayed in the right-hand panel of Figure below.

Source

# This example builds on onto Example 2.4

import numpy as np

""" Plots """

# Create Figure and subplots

fig = plt.figure(figsize=(12, 5))

ax1 = fig.add_subplot(121)

# Visualize Moving average:

# Plot Residuals

sns.residplot(x=yfit, y=res, data=df,

lowess=False, scatter_kws={'alpha': 0.5})

# Plot vertical lines and average to visualize moving average

bandwidth = 0.5

for x_avg in [9.5, 17.5]:

# Find indices where ypred is within range

index_res = (np.where(ypred > (x_avg - bandwidth)) and

np.where(ypred < (x_avg + bandwidth)))

# Find mean of Residuals

res_mean = res[index_res[0]].mean()

# Plot lines

plt.plot((x_avg-bandwidth, x_avg - bandwidth ),

[-10, 10], color='darkgrey')

plt.plot((x_avg+bandwidth, x_avg + bandwidth ),

[-10, 10], color='darkgrey')

# Plot average

plt.plot(x_avg, res_mean, color='red', marker='o', markersize=8)

# Set labels

ax1.set_xlabel('Fitted Sales')

ax1.set_ylabel('Residuals')

# Find moving average over full domain

# create x vector

x_avg = np.linspace(ypred.min() + bandwidth,

ypred.max() - bandwidth, 100)

res_mean = []

for x_ in x_avg:

# Find indices where ypred is within range

index_res = (np.where(ypred > (x_ - bandwidth)) and

np.where(ypred < (x_ + bandwidth)))

# Find mean of Residuals

res_mean.append(res[index_res[0]].mean())

# Second subplot:

ax2 = fig.add_subplot(122)

# Plot Residuals

sns.residplot(x=yfit, y=res, data=df,

lowess=False, scatter_kws={'alpha': 0.5})

# Plot moving average:

plt.plot(x_avg, res_mean, 'r-', linewidth=5)

# Set labels

ax2.set_xlabel('Fitted Sales')

ax2.set_ylabel('Residuals')

# Show plot

plt.show()

LOESS smoother [7]¶

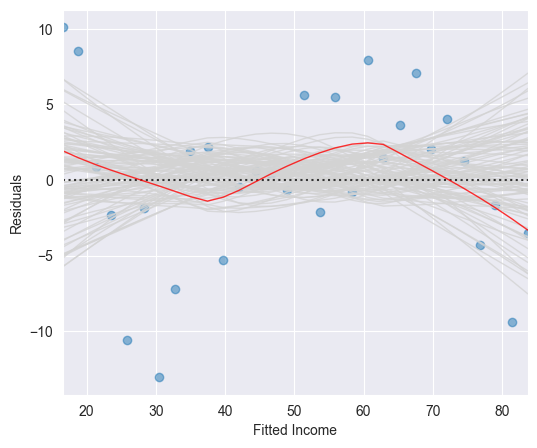

We generate for the Income data the Tukey-Anscombe plot along with the LOESS smoothing curve (see the Figure below).

Source

import pandas as pd

import seaborn as sns

import statsmodels.api as sm

from matplotlib import pyplot as plt

from TMA_def import plot_residuals, plot_reg

# Read data

df = pd.read_csv('data/Income.csv')

x = df['education']

y = df['income']

# Fit Linear Model

x_sm = sm.add_constant(x)

model = sm.OLS(y, x_sm).fit()

# Find the predicted values for the original design.

yfit = model.fittedvalues

# Find the Residuals

res = model.resid

# Create Figure and subplots

fig = plt.figure(figsize=(12, 5))

ax1 = fig.add_subplot(121)

# Plot data using definition from TMA_def

plot_reg(ax1, x, y, model, x_lab="Years of Education",

y_lab="Income", title="Linear Regression")

# Second Subplot

ax2 = fig.add_subplot(122)

# Plot Residuals using definition from TMA_def

plot_residuals(ax2, yfit, res, n_samp=0, x_lab="Fitted Income")

# Show plots

plt.show()

The red smoothing curve is not passing any more near to the dashed line. We are now confronted with the question whether the observed deviation of the smoothing curve from the line is plausible when assuming an underlying linear model. In other words, did the observed deviation simply occur due to a random variation or is there a systematic deviation from a linear model?

If we repeat the measurements, then we would observe a different distribution of the data points and the smoothing curve would follow a different path. If the new smoothing curve then passes next to the line, we would not have any reason to question the linearity assumption.

But how can we decide whether a smoothing curve systematically deviates from the line, or when is this just due to a random variation? Generally, this is an expert call based on the magnitude of the deviation and the number of data points which are involved. An elegant way out of these (sometimes difficult) considerations is given by a resampling approach.

The principle idea of our resampling approach consists of simulating data points on the basis of the existing data set. For the simulated data points we fit a smoothing curve and add it to the Tukey-Anscombe plot.

Source

import random

random.seed(0)

n_samp = 100 # Number of resamples

# Create Figure and subplots

fig = plt.figure(figsize=(6,5))

ax1 = fig.add_subplot(111)

# For every random resampling

for i in range(n_samp):

# 1. resample indices from Residuals

samp_res_id = random.sample(list(res), len(res))

# 2. Average of Residuals, smoothed using LOWESS

sns.regplot(x=yfit, y=samp_res_id,

scatter=False, ci=False, lowess=True,

line_kws={'color': 'lightgrey', 'lw': 1, 'alpha': 0.8})

# 3. Repeat again for n_samples

# Plot original smoothing curve

sns.residplot(x=yfit, y=res, data=df,

lowess=True, scatter_kws={'alpha': 0.5},

line_kws={'color': 'red', 'lw': 1, 'alpha': 0.8})

plt.xlabel("Fitted Income")

plt.ylabel("Residuals")

# Show plots

plt.show()

These simulated smoothing curves illustrate the magnitude which a random deviation from the line can take on. It may help us to assess the smoothing curve constructed on the basis of the original residuals.

If the underlying regression function is linear, then the (grey) band resulting from the simulated smoothing curves should follow the line and contain the original (red) smoothing curve fitted on the basis of the original data set.

The red smoothing curve displayed in the Figure above lies within the (grey) band of simulated smoothing curves. We therefore conclude that the wiggly shape of the (red) smoothing curve is not critical. We thus may assume a linear underlying regression function .

Source

import pandas as pd

import numpy as np

import seaborn as sns

import statsmodels.api as sm

from matplotlib import pyplot as plt

# Load data

df = pd.read_csv('data/Advertising.csv')

x = df['TV']

y = df['sales']

# Fit Linear Model

x_sm = sm.add_constant(x)

model = sm.OLS(y, x_sm).fit()

# Find the predicted values for the original design.

yfit = model.fittedvalues

# Residuals of the model

res = model.resid

# Influence of the Residuals

res_inf = model.get_influence()

# Studentized residuals using variance from OLS

res_standard = res_inf.resid_studentized_internal

# Absolute square root Residuals:

res_stand_sqrt = np.sqrt(np.abs(res_standard))

# Create Figure and subplots

fig = plt.figure(figsize=(6, 5))

ax1 = fig.add_subplot(111)

# plot Square rooted Residuals

plt.scatter(yfit, res_stand_sqrt, alpha=0.5)

# plot Regression usung Seaborn

sns.regplot(x=yfit, y=res_stand_sqrt,

scatter=False, ci=False, lowess=True,

line_kws={'color': 'red', 'lw': 1, 'alpha': 0.8})

ax1.set_title('Scale-Location plot')

ax1.set_xlabel('Fitted Sales values')

ax1.set_ylabel('$\sqrt{\|Standardized\ Residuals\|}$')

# Show plot

plt.show()

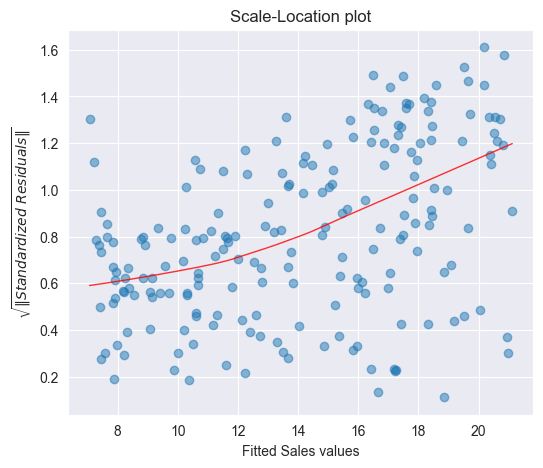

We observe that the magnitude of the residuals tend to increase with the fitted values, indicating a non-constant variance of the error terms . To test whether this deviation is due to a random variation or whether it is of systematic nature, we will run again simulations by resampling the data.

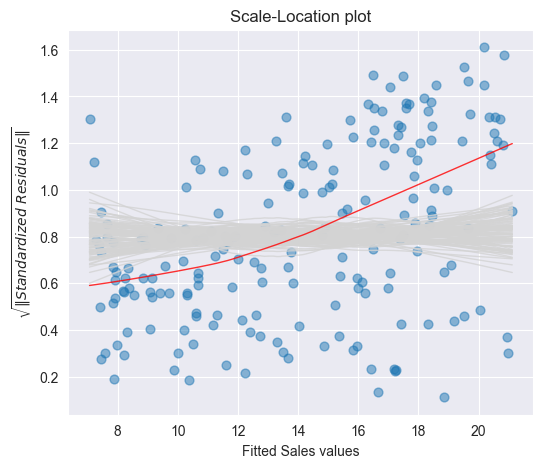

To see whether a deviating smoothing curve in a scale location plot may be related to a random effect, we run again simulations by sampling the data with replacement and by fitting smoothing curves on the basis of the resampled data. The Figure below displays a band of 100 simulated smoothing curves that were fitted on the basis of the resampled data.

Since the (red) curve does not follow a path contained within this (grey) band of curves, we conclude that there is a systematic increase of the variances.

Source

from TMA_def import plot_scale_loc

n_samp = 100 # Number of resamples

# Create Figure

fig = plt.figure(figsize=(6, 5))

ax1 = fig.add_subplot(111)

# Plot Standardized Residuals using definition from TMA_def

plot_scale_loc(ax1, yfit, res_stand_sqrt, n_samp=100,

x_lab="Fitted Sales values")

# Show plot

plt.show()

Histogram [9]¶

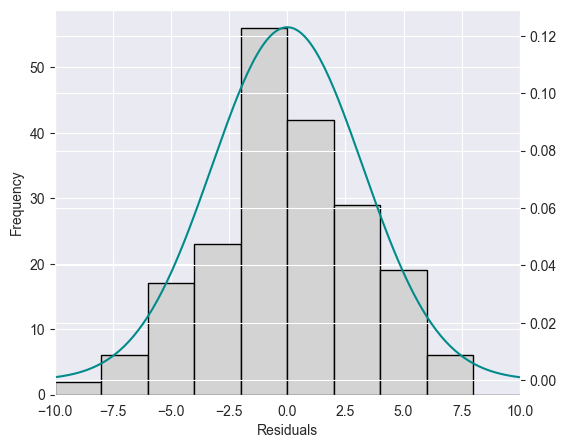

The residuals of the Advertising data set are plotted as a histogram in the Figure below. A normal density function with mean and variance estimated on the basis of the data is shown in green.

Source

import pandas as pd

import numpy as np

import statsmodels.api as sm

from matplotlib import pyplot as plt

from scipy.stats import norm

# Load data

df = pd.read_csv('data/Advertising.csv')

x = df['TV']

y = df['sales']

# Fit Linear Model

x_sm = sm.add_constant(x)

model = sm.OLS(y, x_sm).fit()

# Find the predicted values for the original design.

yfit = model.fittedvalues

# Residuals of the model

res = model.resid

# Create Figure and subplots

fig = plt.figure(figsize=(6, 5))

ax1 = fig.add_subplot(111)

# Plot histogram

res_bins = np.arange(-10, 12, 2)

plt.hist(res, bins=res_bins,

facecolor="lightgrey", edgecolor="k" )

plt.xlabel('Residuals')

plt.ylabel('Frequency')

plt.xlim(-10, 10)

plt.ylim(bottom=0)

# Plot estimated Normal density function

# new x axis

ax2 = ax1.twinx()

# Estimate mean and standard deviation

mu = np.mean(res)

sigma = np.std(res)

x_pdf = np.arange(-10, 10.1, 0.1)

# Plot Normal density function

ax2.plot(x_pdf, norm.pdf(x_pdf, mu, sigma),

'-', color="darkcyan", alpha=1)

# Show plot

plt.show()

It is in general difficult to judge on the basis of a histogram whether the data is normally distributed. In addition, histograms are sensitive with respect to the chosen interval width.

Q-Q plot [10]¶

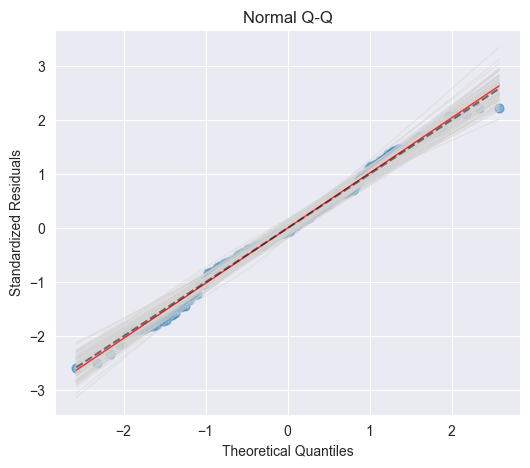

A Q-Q plot or normal plot is another graphical tool to verify whether the data is normally distributed. In our context, we plot the quantiles of the empirical residuals versus the theoretical quantiles of a normal distribution. Instead of the residuals we however use the standardized residuals in our Q-Q plot.

Source

import seaborn as sns

from statsmodels.graphics.gofplots import ProbPlot

# Influence of the Residuals

res_inf = model.get_influence()

# Studentized residuals using variance from OLS

res_standard = res_inf.resid_studentized_internal

# QQ plot instance

QQ = ProbPlot(res_standard)

# Split the QQ instance in the seperate data

qqx = pd.Series(sorted(QQ.theoretical_quantiles), name="x")

qqy = pd.Series(QQ.sorted_data, name="y")

# Create Figure and subplots

fig = plt.figure(figsize=(6, 5))

ax1 = fig.add_subplot(111)

sns.regplot(x=qqx, y=qqy, scatter=True, lowess=False, ci=False,

scatter_kws={'s': 40, 'alpha': 0.5},

line_kws={'color': 'red', 'lw': 1, 'alpha': 0.8})

ax1.plot(qqx, qqx, '--k', alpha=0.5)

# Set labels

plt.title('Normal Q-Q')

plt.xlabel('Theoretical Quantiles')

plt.ylabel('Standardized Residuals')

plt.show()

If the data actually originates from a normal distribution, then the data points will scatter just slightly around the straight line in the Q-Q plot.

If we observe a deviation from the straight line in the Q-Q plot, then the question comes up whether such a deviation is systematic or due to a random variation. In order to answer this question, we run again simulations. In particular, we draw 100 random samples of length (number of residuals) from a normal distribution that shares mean and standard deviation with the standardized residuals. The Figure below displays a band of simulated (grey) curves in the case of normally distributed residuals : these curves may be observed due to random variations. Since the points for the Advertising data set lie within this band, we consider the residuals to originate from a normal distribution

Source

# Split the QQ instance in the seperate data

qqx = pd.Series(sorted(QQ.theoretical_quantiles), name="x")

qqy = pd.Series(QQ.sorted_data, name="y")

# Estimate the mean and standard deviation

mu = np.mean(qqy)

sigma = np.std(qqy)

# Create Figure

fig = plt.figure(figsize=(6, 5))

ax1 = fig.add_subplot(111)

n_samp = 100 # Number of resamples

# For ever random resampling

for lp in range(n_samp):

# Resample indices

samp_res_id = np.random.normal(mu, sigma, len(qqx))

# Plot

sns.regplot(x=qqx, y=sorted(samp_res_id),

scatter=False, ci=False, lowess=True,

line_kws={'color': 'lightgrey', 'lw': 1, 'alpha': 0.4})

# Add plots for original data and the line x = y

sns.regplot(x=qqx, y=qqy, scatter=True, lowess=False, ci=False,

scatter_kws={'s': 40, 'alpha': 0.5},

line_kws={'color': 'red', 'lw': 1, 'alpha': 0.8})

ax1.plot(qqx, qqx, '--k', alpha=0.5)

# Set limits and labels

plt.title('Normal Q-Q')

plt.xlabel('Theoretical Quantiles')

plt.ylabel('Standardized Residuals')

plt.show()

Independence [11]¶

An important assumption of the linear regression model is that the error terms, , are independent. What does this mean? For instance, if the errors are independent, then the fact that is positive provides little or no information about the sign of . The standard errors that are computed for the estimated regression coefficients or the fitted values are based on the assumption of independent error terms. If in fact there is correlation among the error terms, then the estimated standard errors will tend to underestimate the true standard errors. As a result, confidence and prediction intervals will be narrower than they should be. For example, a confidence interval may in reality have a much lower probability than 0.95 of containing the true value of the parameter. In addition, p-values associated with the model will be lower than they should be; this could cause us to erroneously conclude that a parameter is statistically significant. In short, if the error terms are correlated, we may have an unwarranted sense of confidence in our model.

Outliers and High Leverage Points [12]¶

Outlier¶

An outlier is a point for which is far from the value predicted by the model. Outliers can arise for a variety of reasons, such as incorrect recording of an observation during data collection.

High Leverage Point¶

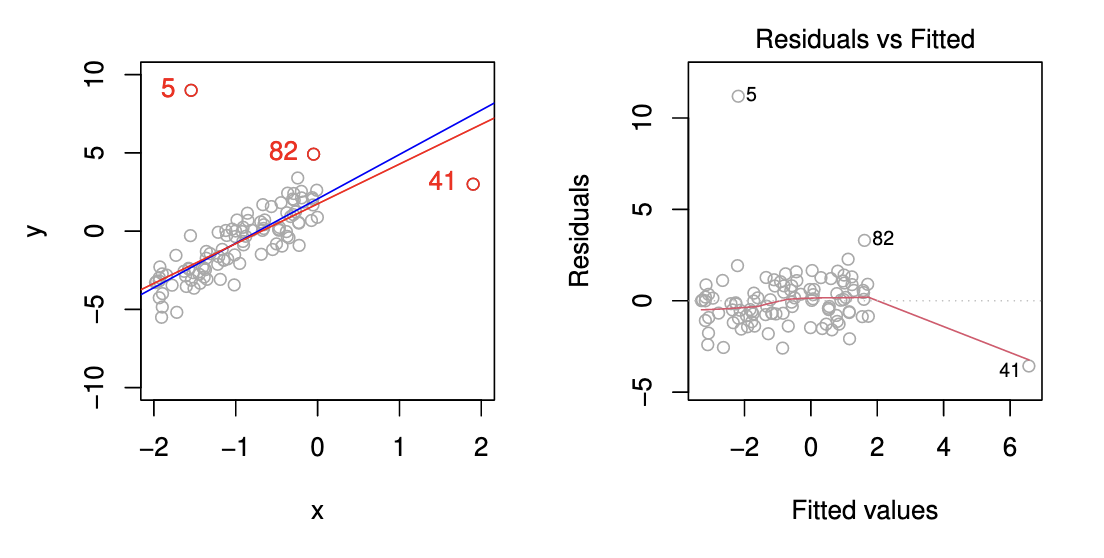

We just saw that outliers are observations for which the response is unusual given the predictor . In contrast, observations with high leverage have an unusual value for . For example, observation 41 in the Figure below has high leverage, in that the predictor value for this observation is large relative to the other observations. Contrary to observation 41, observation 5 has an unusually large -value relative to . Observation 5 however is an outlier and does not have a high leverage since the predictor value is near to the other predictor values.

Leverage Statistic¶

In order to quantify an observation’s leverage, we compute the leverage statistic. A large value of this statistic indicates an observation with high leverage. For a simple linear regression the value of the leverage statistic associated with the th observation is given by

It is clear from this equation that increases with the distance of from . We interpret a high leverage point as a point having a large distance from the center of gravity and thereby having a high “momentum to turn the regression line around”.

Cook’s Distance¶

By means of the leverage statistic we can define another statistic to measure the influence of an observation: Cook’s distance. Cook’s distance measures to which extent the predicted value changes if the th observation is removed:

where denotes the vector of predicted values if the th observation is removed. Cook’s distance can efficiently be calculated by means of the leverage statistic and the standardized residual :

The larger the value of Cook’s distance is, the higher is the influence of the corresponding observation on the estimation of the predicted value . In practice, we consider a value of Cook’s distance larger than 1 as dangerously influential.

Summary¶

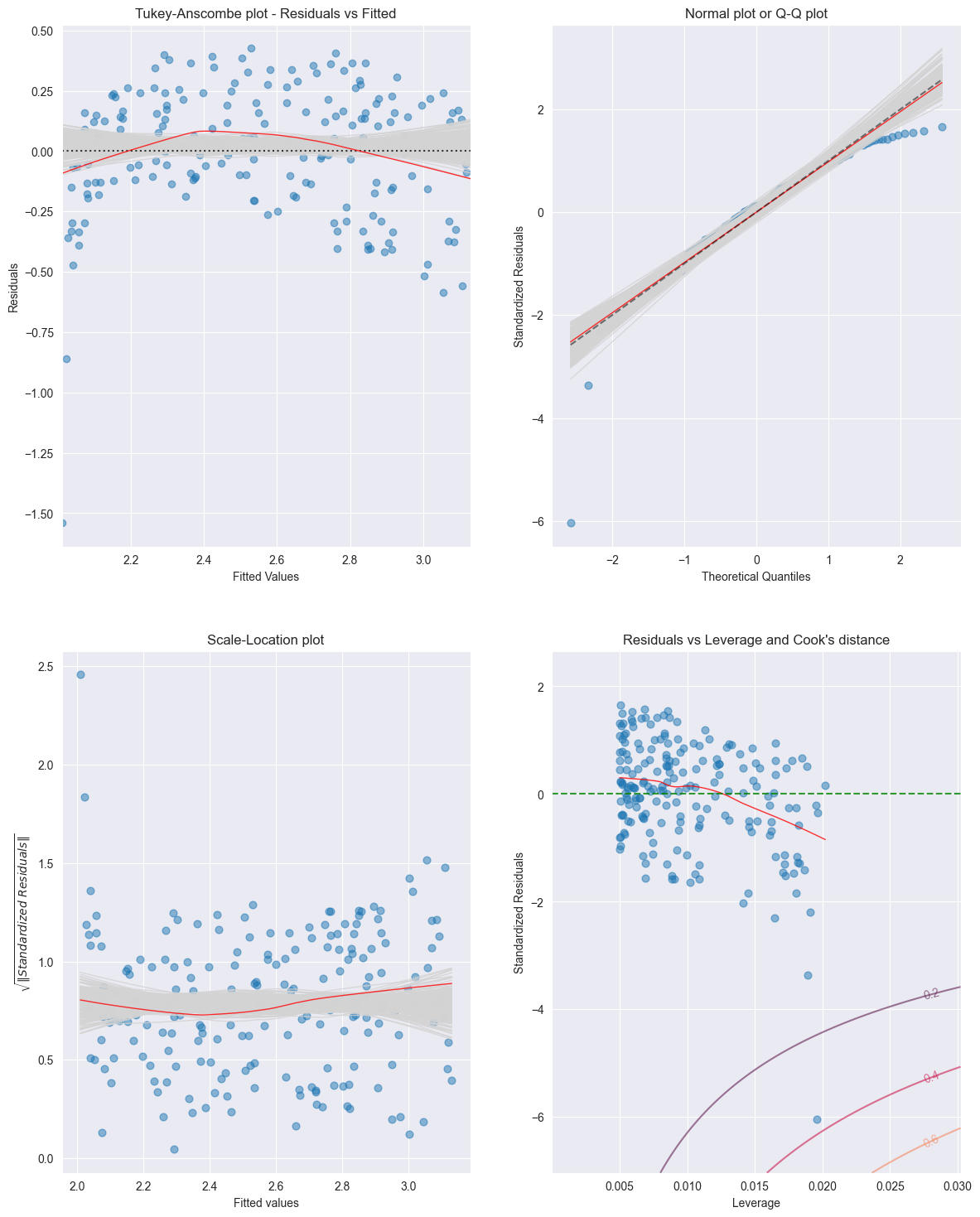

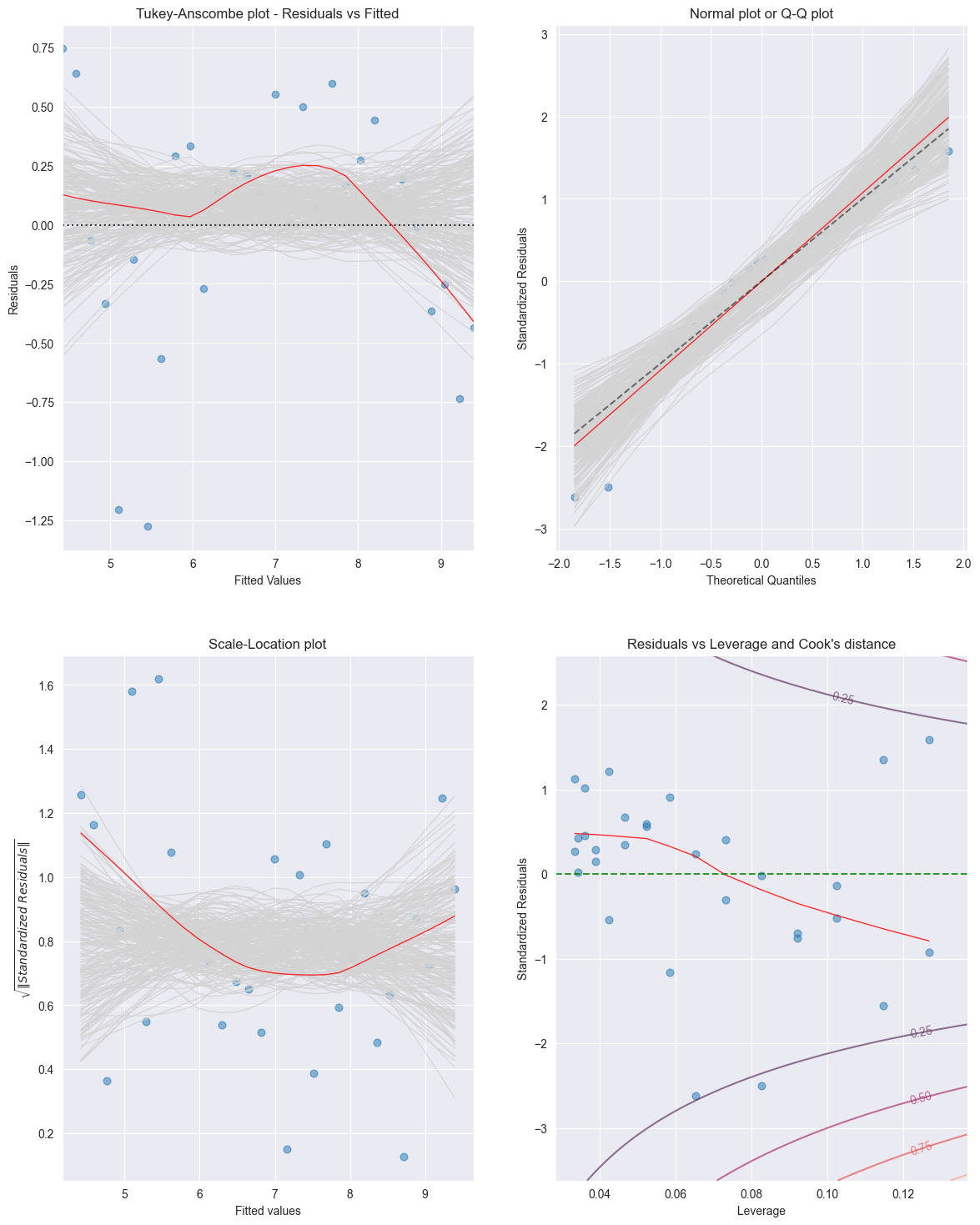

We have seen 4 possibilities how to analyze residuals graphically:

Tukey–Anscombe-Plots

Scale location plot

Q-Q plot

Cook’s Distance

For the Advertising data set these residual plots are displayed in the Figure below [13]

Source

import statsmodels.api as sm

from TMA_def import *

# Read data

df = pd.read_csv('data/Advertising.csv')

x = df['TV']

y = df['sales']

# Reformat Data

dataframe = pd.concat([x, y], axis=1)

""" Find Predictions, Residuals and Influence on the Residuals """

# Fit Linear Model

x_sm = sm.add_constant(x)

model = sm.OLS(np.log(y), x_sm).fit()

tma_plots(model, n_samp = 200)

For the Income data set the residual plots are displayed in the Figure below [14]

Source

import statsmodels.api as sm

from TMA_def import *

# Read data

df = pd.read_csv('data/Income.csv')

x = df['education']

y = df['income']

""" Find Predictions, Residuals and Influence on the Residuals """

# Fit Linear Model

x_sm = sm.add_constant(x)

model = sm.OLS(np.sqrt(y), x_sm).fit()

tma_plots(model, n_samp = 200)

Birbaumer et al., 2025, p. 129

Birbaumer et al., 2025, p. 137

Birbaumer et al., 2025, Example 6.2.3

Birbaumer et al., 2025, p. 140

Birbaumer et al., 2025, Example 6.2.4

Birbaumer et al., 2025, Example 6.2.5

Birbaumer et al., 2025, Example 6.2.6

Birbaumer et al., 2025, Example 6.2.9

Birbaumer et al., 2025, Example 6.2.11

Birbaumer et al., 2025, Example 6.2.12

Birbaumer et al., 2025, p. 158

Birbaumer et al., 2025, p. 160

Birbaumer et al., 2025, Example 6.2.14

Birbaumer et al., 2025, Example 6.2.15

- Birbaumer, M., Frick, K., Büchel, P., & van Hemert, S. (2025). Predictive Modeling - Lecture Notes.