Forecasting

Autoregressive Models¶

Definition [1]¶

Autoregressive models are based on the idea that the current value of the series can be explained by a linear combination of the previous values. To be more precise

Autoregressive models are exclusively used for the modeling of stationary processes. However, the above definition does not guarantee stationarity. There may be combinations of model parameters that lead to non-stationary processes. We will give a sufficient condition on the parameters that render the process stationary further below. For the time being we study an important special case: the process.

That means that the random walk is a special case of an AR(1) with .

Stationarity [2]¶

Stationarity in an process [3]¶

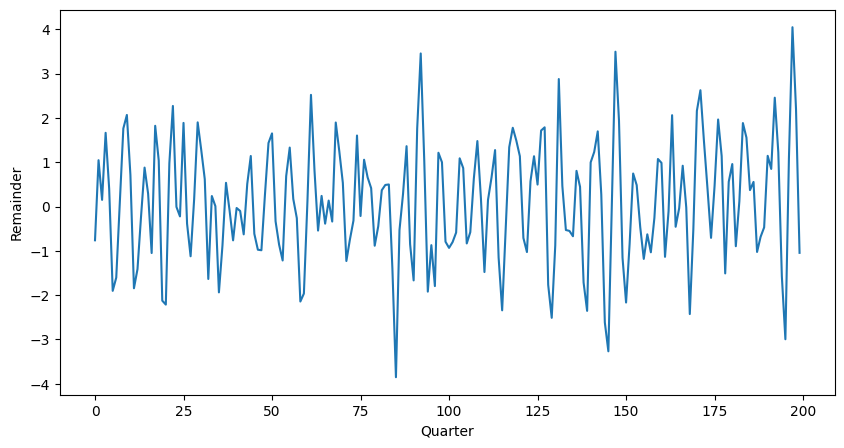

We study the AR(3) process

We compute the absolute values of the roots of the characteristic polynomial

Source

import numpy as np

# note order: p[0] * x**n + p[1] * x**(n-1) + ... + p[n-1]*x + p[n]

abs_roots = abs(np.roots([0.1, 0.5, -0.5, 1]))

print(abs_roots)[6.09052833 1.28136399 1.28136399]

We can see that all the values are larger than 1 and hence the process is stationary. We can simulate a time series from this model with the arima_process.ArmaProcess() method from statsmodels.tsa.

Source

import matplotlib.pyplot as plt

from statsmodels.tsa.arima_process import ArmaProcess

# Simulate time series using ArmaProcess

ar3 = [1, -0.5, 0.5, 0.1]

simulated_data = ArmaProcess(ar3, ma=[1])

simulated_data = simulated_data.generate_sample(nsample=200)

# plot

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

ax.plot(simulated_data)

plt.xlabel("Quarter")

plt.ylabel("Remainder")

plt.show()

The figure shows an AR(3) realization of the code above.

Partial Autocorellation [4]¶

The precise mathematical definition above is somewhat technical and we will not embark further on theoretical aspects, exact computation, etc. We mention, however, that for an autoregressive process AR() the partial autocorrelation has two very important properties:

With these properties we have a tool at hand to investigate a given autoregressive time series and determine the order of the model: compute the partial autocorrelation and choose the largest lag for which the value is not zero. In Python the partial autocorrelation of a stationary time series is estimated with the pacf() function.

Autocorrelation in an process [5]¶

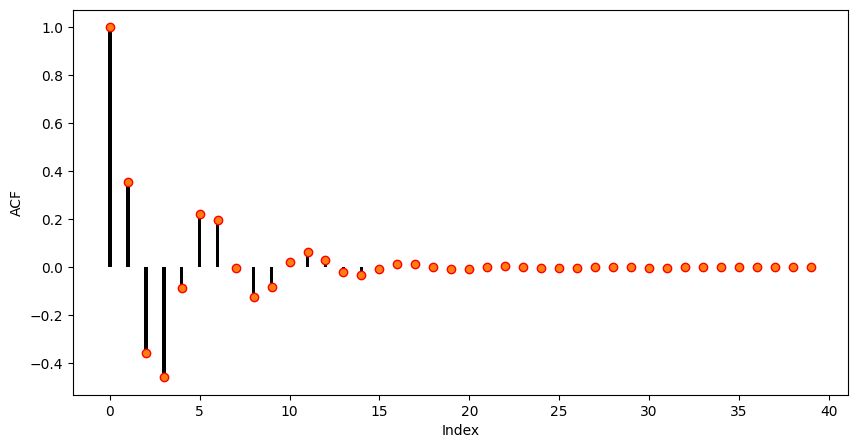

We study the AR(3) process. The process is defined by the coefficients , and . We use ArmaProcess() to simulate the data, and .acf() to find the autocorrelation function.

Source

# Compute the theoretical autocorrelation function

lag = 40

acf_theor = ArmaProcess(ar = ar3)

acf_theor = acf_theor.acf(lag)

# Plot

x = np.arange(lag)

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

plt.bar(x, acf_theor, width=0.2, color="black")

plt.plot(x, acf_theor, "ro", markerfacecolor="C1")

plt.xlabel("Index")

plt.ylabel("ACF")

plt.show()

As it can be seen the autocorrelation of the given AR(3) is oscillating and decreasing essentially following an exponential function. This is the typical autocorrelation behaviour of an autoregressive process.

Partial Autocorrelation in an process [6]¶

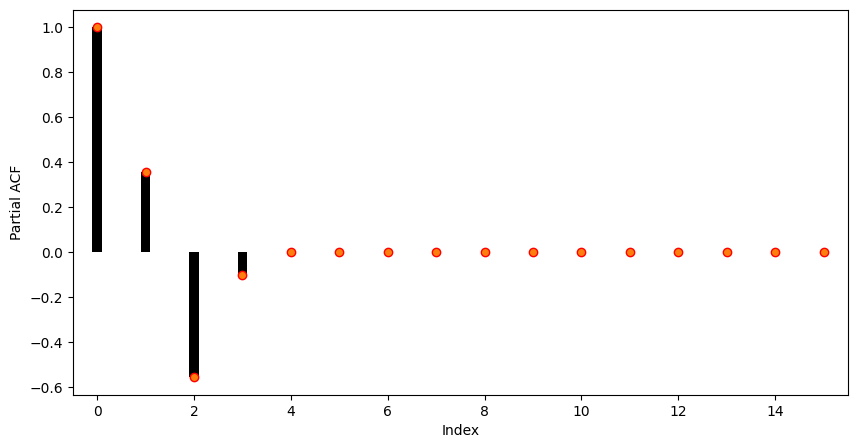

We consider the time series generated from an AR(3) process.

Source

# Compute the partial autocorrelation function

pacf_theor = ArmaProcess(ar=ar3)

pacf_theor = pacf_theor.pacf(lag)

# Plot

x = np.arange(lag)

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

ax.bar(x, pacf_theor, width=0.2, color="black")

ax.plot(x, pacf_theor, "ro", markerfacecolor="C1")

ax.set_xlim([-0.5, 15.5])

plt.xlabel("Index")

plt.ylabel("Partial ACF")

plt.show()

As it can be seen, the partial autocorrelation coefficients larger than 3 are almost zero. So in practice, i.e. when only the time series is at hand, we would choose an autoregressive model of order 3 for modelling the present sequence.

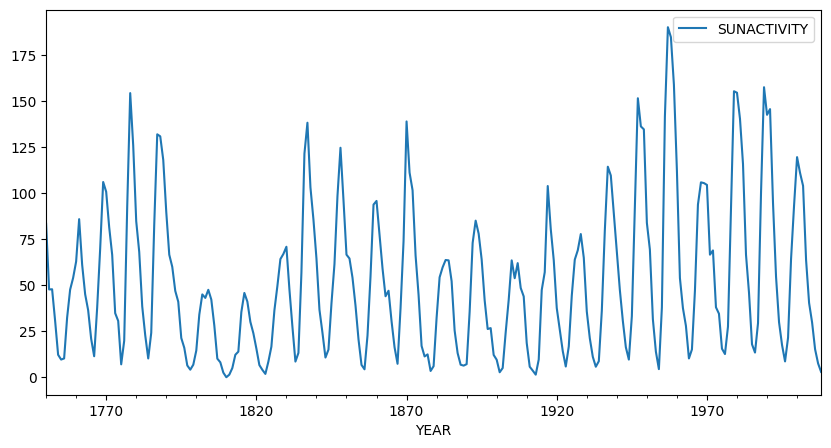

Forecasting Solar Activity [7]¶

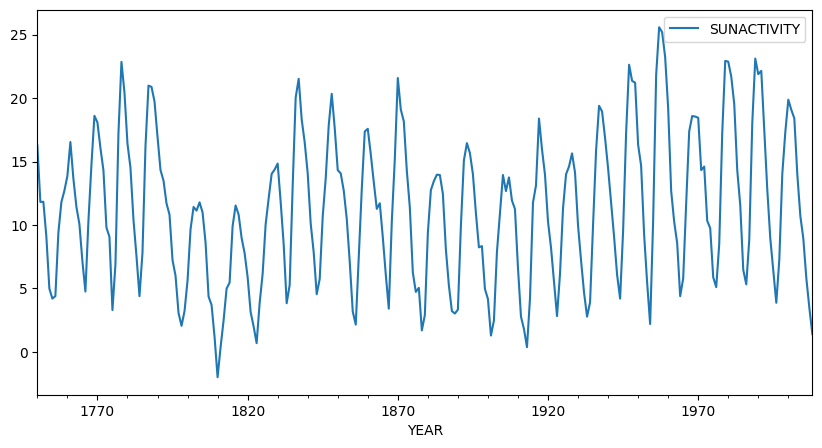

Forecasting solar activity is important for satellite drag, telecommunication outages and solar winds in connection with blackout of power plants. As an indicator of solar activity the sunspot number is used, among others. The Swiss astronomer Johann Rudolph Wolf introduced the sunspot number in 1848 and the number of sunspots is now known on a monthly basis back to the year 1749 (from 1749 to 1848 the data is questionable). The data set produces the following plot:

Source

import statsmodels.api as sm

import pandas as pd

import matplotlib.pyplot as plt

# Load data

dta = sm.datasets.sunspots.load_pandas().data

# Create pandas DateTimeIndex

dtindex = pd.DatetimeIndex(data=pd.to_datetime(dta["YEAR"], format="%Y"),

freq='infer')

# Set as Index

dta.set_index(dtindex, inplace=True)

dta.drop("YEAR", axis=1, inplace=True)

# Select only data after 1750

dta = dta["1750":"2008"]

# Plot

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

dta.plot(ax=ax)

plt.show()

It is important to note that the sunspot data is not periodic, i.e. the cycle duration is not constant. So the quasi periodic behaviour must not be mistaken for seasonality. The peaks and minima of the series are not known in advance.

Eyeballing indicates that the underlying process is not stationary: There are clearly phases with different variances and means. We perform a Box-Cox square-root transform to stabilize the variance.

Source

import numpy as np

# Box-Cox square root transformation

dta_sq = (np.sqrt(dta) - 1) * 2

# Plot

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

dta_sq.plot(ax=ax)

plt.show()

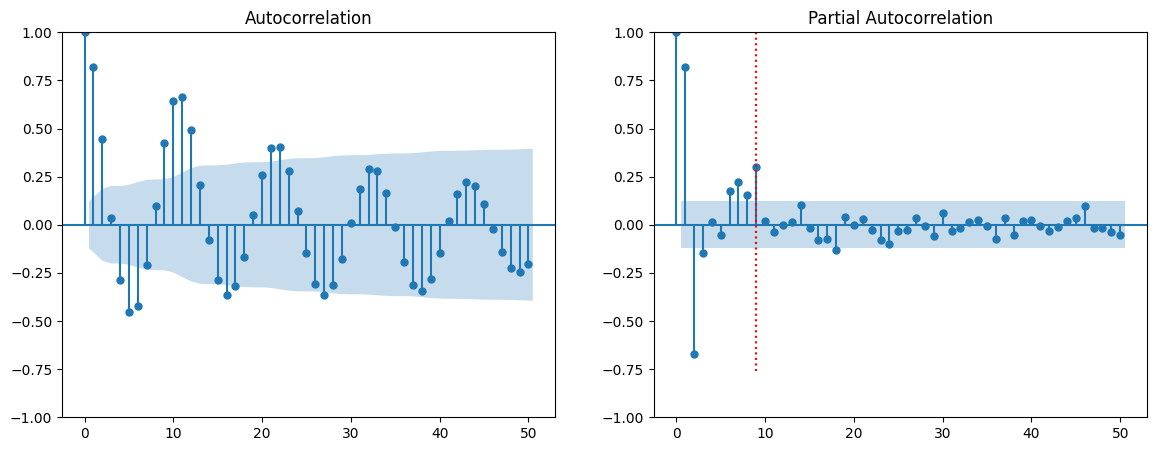

The square-root transformed sequence is shown. The variance is visually stabilized and although there is still some trend visible, the series looks fairly stationary after the transformation. Next, we compute the autocorrelation and partial autocorrelation functions in order to clarify whether the autoregressive model is the right choice and in case to determine the proper model order.

Source

from statsmodels.graphics.tsaplots import plot_pacf

from statsmodels.graphics.tsaplots import plot_acf

# Plot

fig = plt.figure(figsize=(14, 5))

ax1 = fig.add_subplot(1, 2, 1)

plot_acf(dta_sq, lags=50, ax=ax1)

ax2 = fig.add_subplot(1, 2, 2)

plot_pacf(dta_sq, lags=50, ax=ax2)

ax2.plot([9, 9], [-0.76, 1], ':r')

plt.show()

The autocorrelation (left) and partial autocorrelation (right) are depicted. As it can be seen, the autocorrelation shows the typical behaviour of an autoregressive process: an oscillating pattern with an exponential decay. The partial autocorrelation shows that the direct dependency has a maximum lag of 9 which we will use as our model parameter in the next section. The red dotted line marks this threshold.

Fitting an Autoregressive Model [8]¶

The process of fitting an autoregressive model is as follows:

The first two items are done by visual inspection of the (partial) correlogram. We will now focus on the estimation part. We do not go into detail, but will just mention the most basic approach to estimate the coefficients: ordinary least squares.

Given the data and a model order , we fit the AR() process to the data by solving the following linear equation system

The system is solved in the least squares sense and it is assumed that the mean has been subtracted from the time series in advance. The solution of these equations are the estimates . There are at least three further methods that are standard for estimating the AR() coefficients; the estimates are in general different but asymptotically (i.e. for large ) identical.

Burg’s algorithm: The least squares approach above has the drawback that the first values are never used as responses. Burg’s method remedies this shortcoming and exploits the fact that an AR() is also an AR() when viewed backward in time.

Yule–Walker equations: This method transforms the above equations such that the autocorrelations instead of the time series itself appear in the equation. Then the sample ACF is plugged in and the system is solved.

Maximum Likelihood Method: It maximizes the likelihood to observe the given data given the process as parameters . For computing the likelihood function it is assumed that the white noise process in fact is Gaussian.

In Python all three methods are implemented, and can be called in the generic .fit() function through method="yule_walker", "burg", etc.

Fitting the Sunspot number data set [9]¶

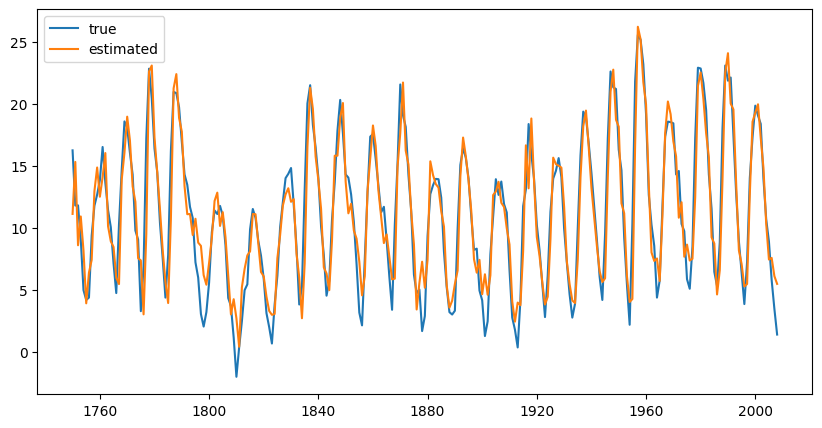

We have a look at the sunspot number data set. We have transformed the data by a square-root and have concluded that it stems from an AR(9) model. We will now fit this model to the data

Source

from statsmodels.tsa.arima.model import ARIMA

model = ARIMA(dta_sq, order=(9, 0, 0)).fit(method="yule_walker")

# Plot

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

ax.plot(dta_sq, label='true')

ax.plot(dta_sq["SUNACTIVITY"] - model.resid, label='estimated')

plt.legend()

plt.show()

Source

print(model.summary()) SARIMAX Results

==============================================================================

Dep. Variable: SUNACTIVITY No. Observations: 259

Model: ARIMA(9, 0, 0) Log Likelihood -565.246

Date: Thu, 13 Nov 2025 AIC 1152.492

Time: 10:50:37 BIC 1191.617

Sample: 01-01-1750 HQIC 1168.222

- 01-01-2008

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 11.1370 1.211 9.200 0.000 8.764 13.510

ar.L1 1.1625 0.062 18.675 0.000 1.040 1.284

ar.L2 -0.4175 0.090 -4.658 0.000 -0.593 -0.242

ar.L3 -0.1587 0.100 -1.582 0.114 -0.355 0.038

ar.L4 0.2157 0.121 1.781 0.075 -0.022 0.453

ar.L5 -0.1946 0.124 -1.569 0.117 -0.438 0.048

ar.L6 0.0117 0.128 0.092 0.927 -0.239 0.262

ar.L7 0.1507 0.126 1.196 0.232 -0.096 0.398

ar.L8 -0.2071 0.111 -1.872 0.061 -0.424 0.010

ar.L9 0.2989 0.066 4.548 0.000 0.170 0.428

sigma2 5.0341 0.473 10.645 0.000 4.107 5.961

===================================================================================

Ljung-Box (L1) (Q): 0.59 Jarque-Bera (JB): 9.46

Prob(Q): 0.44 Prob(JB): 0.01

Heteroskedasticity (H): 0.71 Skew: 0.36

Prob(H) (two-sided): 0.12 Kurtosis: 3.59

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

The output above shows the 9 estimated coefficients and the estimated variance of the white noise process.

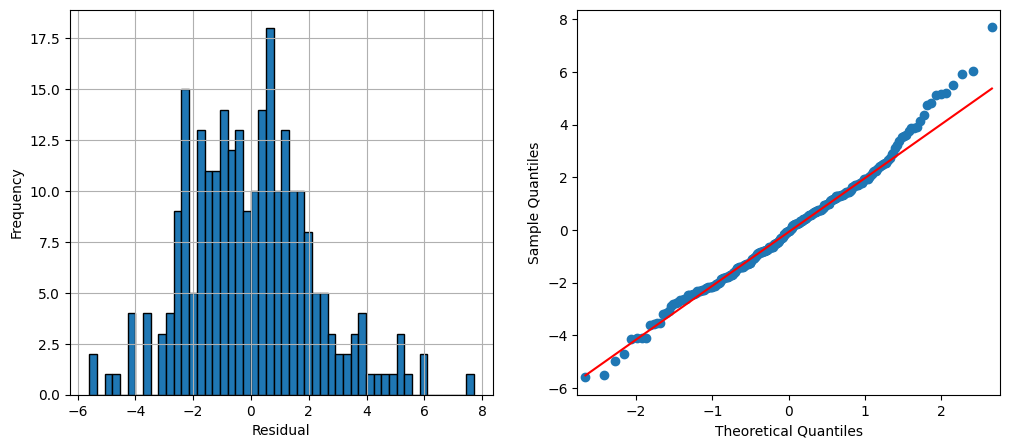

The figure shows the annually averaged time series and the output of the model. The fit seems to be reasonably accurate but we can further assess the result by examining residual plots. We choose a histogram and a qq-plot.

Source

from statsmodels.graphics.api import qqplot

# Plot

fig = plt.figure(figsize=(12, 5))

ax1 = fig.add_subplot(1, 2, 1)

model.resid.hist(edgecolor="black", bins=50, ax=ax1)

plt.xlabel("Residual")

plt.ylabel("Frequency")

ax2 = fig.add_subplot(1, 2, 2)

qqplot(model.resid, line="q", ax=ax2)

plt.show()

Forecasting [10]¶

Eventually we now aim at forecasting future values of a given autoregressive time series. The general methodology of forecasting stationary time series can be summarized as follows.

The above definition requires a model for the time series in order to compute the conditional expectation. We will study the computation of this conditional expectation for autoregressive processes and start with a general AR(1).

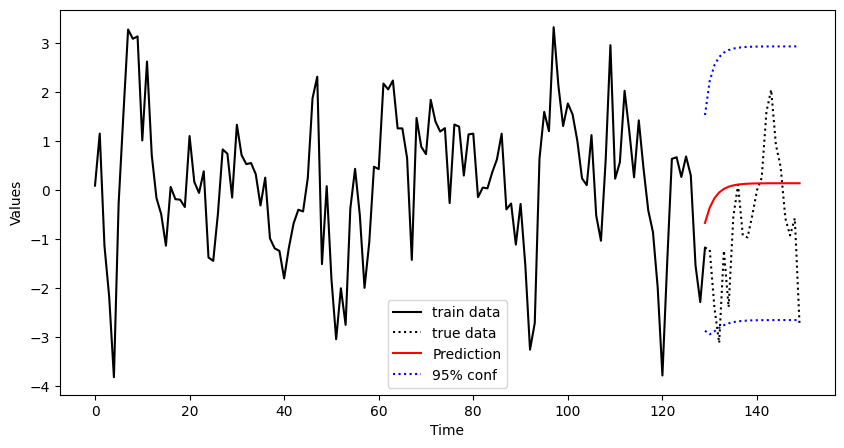

Forecasting Time series Example 1.10:¶

In the following we simulate data from an AR(1) process and predict some future values given these data. We build the model on a subset of the generated data, i.e. we cut off some of the values at the end. We will predict these values and study the residuals.

import pandas as pd

import numpy as np

from statsmodels.tsa.arima_process import ArmaProcess

from statsmodels.tsa.arima.model import ARIMA

import matplotlib.pyplot as plt

# Simulate AR1 Data

np.random.seed(8)

ar1 = [1, -0.7]

simulated_data = ArmaProcess(ar1)

simulated_data = simulated_data.generate_sample(nsample=150)

# Fit model on first 130 points

model = ARIMA(simulated_data[0:130], order=(1, 0, 0)).fit(method="yule_walker")

# Predict last 20 points

pred = model.get_prediction(start=130, end=150).prediction_results

pred_cov = pred._forecasts_error_cov

pred = pred._forecasts[0]

pred_upper = pred + 1.96 * np.sqrt(pred_cov[0][0])

pred_lower = pred - 1.96 * np.sqrt(pred_cov[0][0])

# Plot

x = np.arange(151)

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

ax.plot(x[0:130], simulated_data[0:130], '-k', label='train data')

ax.plot(x[129:150], simulated_data[129:150], ':k', label='true data')

ax.plot(x[129:150], pred, 'r', label='Prediction')

ax.plot(x[129:150], pred_upper, ':b', label='95% conf')

ax.plot(x[129:150], pred_lower, ':b')

plt.xlabel("Time")

plt.ylabel("Values")

plt.legend()

plt.show()

Finally, we add some confidence bands to the plot. To this end, we use the standard error that is stored in ._forecasts_error_cov. The figure shows the complete data (dotted black) and the training set which consists of the the first 130 observations (solid black). From these data an AR(1) model is built and the values for the remaining 20 observations are predicted (solid red) including confidence limits (dashed red). We see that the true values of the process are within the confidence limits.

Forecasting Time series Example 1.11¶

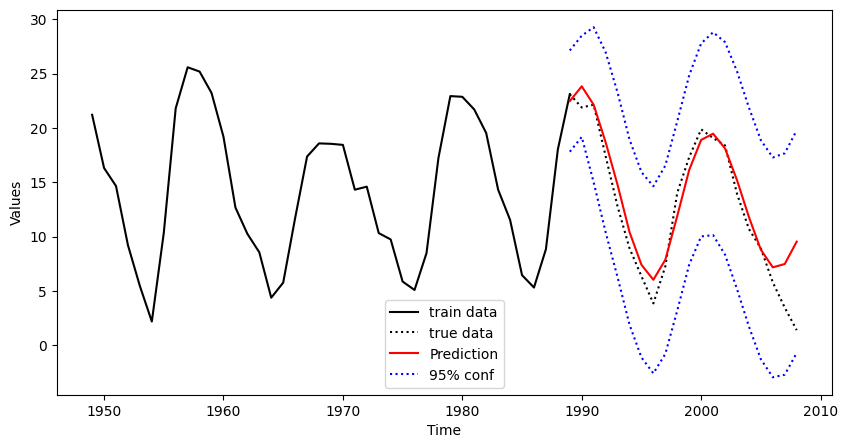

We again focus on the sunspot number data. We use the annual data from 1749 until 1989 as a training set and estimate an AR(9) model from that data. We then predict the sunspot number for 25 years into the future.

# Fit model on first 130 points

model = ARIMA(dta_sq["1749": "1989"], order=(9, 0, 0)).fit(method="yule_walker")

# Predict including confidence interval

pred = model.get_prediction(start="1989", end="2008").prediction_results

pred_cov = pred._forecasts_error_cov

pred = pred._forecasts[0]

pred_upper = pred + 1.96 * np.sqrt(pred_cov[0][0])

pred_lower = pred - 1.96 * np.sqrt(pred_cov[0][0])

# Plot

x = dta_sq.index.year

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

ax.plot(dta_sq["1949": "1989"], '-k', label='train data')

ax.plot(dta_sq["1989": "2009"], ':k', label='true data')

ax.plot(dta_sq["1989": "2009"].index, pred, 'r', label='Prediction')

ax.plot(dta_sq["1989": "2009"].index, pred_upper, ':b', label='95% conf')

ax.plot(dta_sq["1989": "2009"].index, pred_lower, ':b')

plt.xlabel("Time")

plt.ylabel("Values")

plt.legend()

plt.show()

The figure shows a window of the data set from 1950 until 2014. The training set is depicted by a black solid line and ranges up to 1989. The prediction is computed and plotted for the time period 1990 to 2012 together with the true data (black dotted) that has been discarded in the modelling step. As it can be seen, there is good correspondence between true and estimated values for about 15 years. Then the prediction starts to diverge and the second minimum phase is not predicted correctly.

Birbaumer et al., 2025, p. 378

Birbaumer et al., 2025, p. 379

Birbaumer et al., 2025, Example 14.1.3

Birbaumer et al., 2025, p. 381

Birbaumer et al., 2025, Example 14.1.5

Birbaumer et al., 2025, Example 14.1.6

Birbaumer et al., 2025, Example 14.1.7

Birbaumer et al., 2025, p. 387

Birbaumer et al., 2025, Example 14.1.8

Birbaumer et al., 2025, p. 390

- Birbaumer, M., Frick, K., Büchel, P., & van Hemert, S. (2025). Predictive Modeling - Lecture Notes.