ARIMA Models

Repetition¶

Autoregressive Models (AR)¶

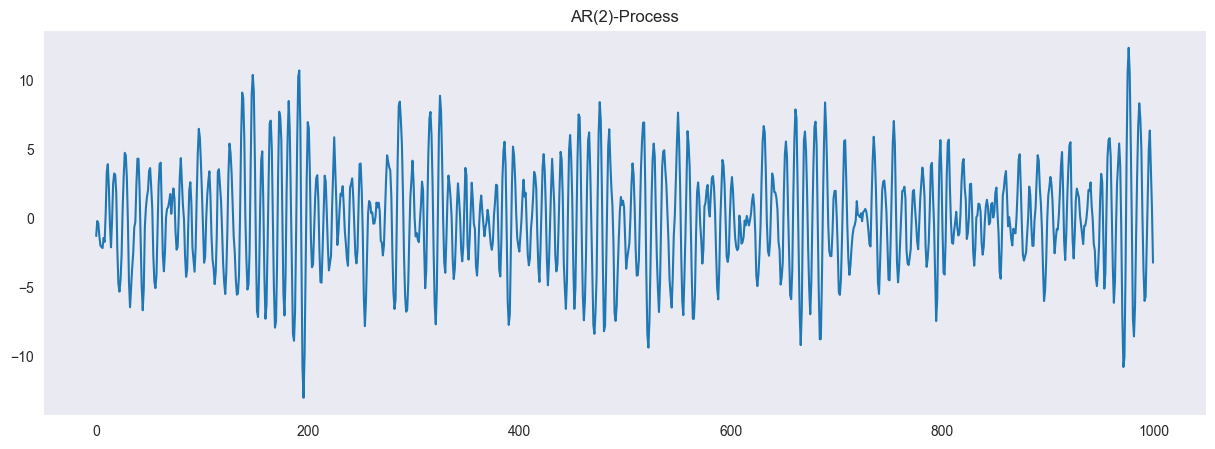

We repeat the concept of autoregressive processes of order p (AR(p)-processes). Intuitively, the value of an AR(p) process at time is a linear combination of the previous values in the series. To be more precise

is a white noise model with standard deviation . We now will generate an AR(2) Model. Let us consider the AR(2) process

Source

from statsmodels.tsa.arima_process import ArmaProcess

import matplotlib.pyplot as plt

import numpy as np

ar2 = [1, -1.5, 0.9]

model = ArmaProcess(ar = ar2, ma = None)

simulated_data = model.generate_sample(nsample=1000)

plt.figure(figsize = (15,5))

plt.plot(simulated_data, '-')

plt.grid()

plt.title("AR(2)-Process")

plt.show()

The characteristic polynomial is given by

If all roots of have an absolute value larger than 1, then the process is stationary. This can easily be checked with the model.isstationary command:

model.isstationaryTrueWe can even compute the complex roots of the polynomial, which are according to the lecture

model.arroots

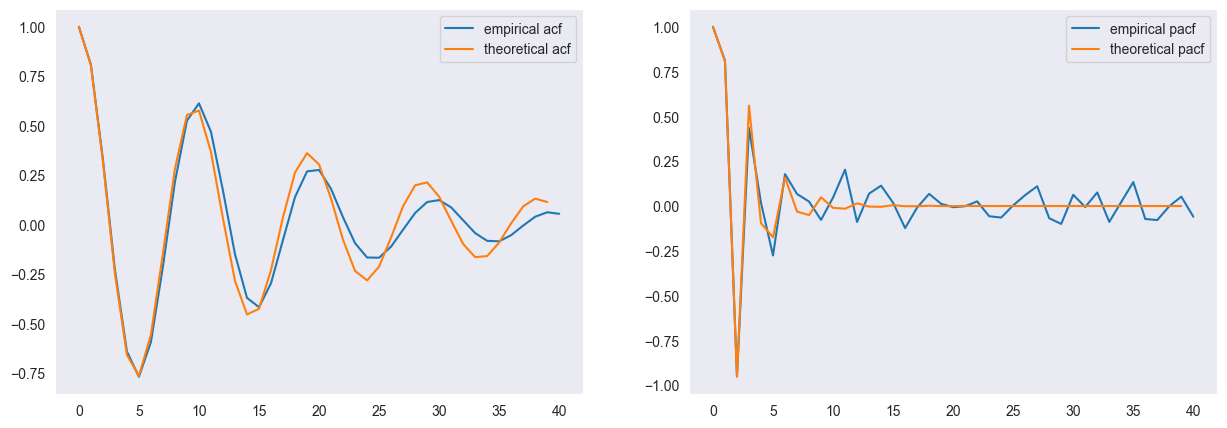

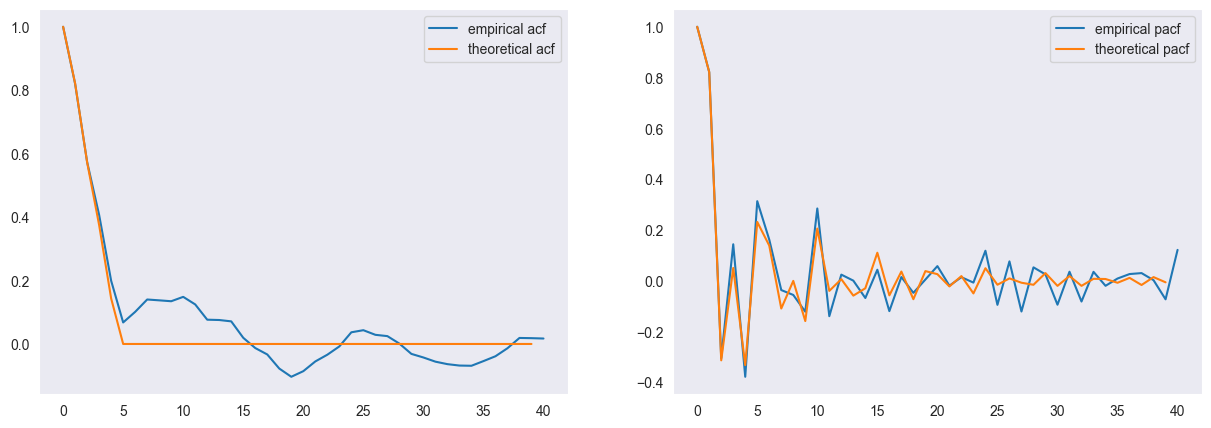

np.abs(model.arroots)array([1.05409255, 1.05409255])Additionally, we compute the autocorrelation and partial autocorrelation both of the generated data (empirical autocorrelation function (acf) / partial autocorrelation function (pacf)) and for the process (theoretical). As we expect, the acf is oscillating and the pacf is vanishing after lags larger than .

from statsmodels.tsa.stattools import acf, pacf

fig, ax = plt.subplots(1,2, figsize = (15,5))

ax[0].plot(acf(simulated_data, nlags=40), label = "empirical acf")

ax[0].plot(model.acf(lags=40), label = "theoretical acf")

ax[0].legend()

ax[0].grid()

ax[1].plot(pacf(simulated_data, nlags=40), label = "empirical pacf")

ax[1].plot(model.pacf(lags=40), label = "theoretical pacf")

ax[1].legend()

ax[1].grid()

Moving Average Model (MA)¶

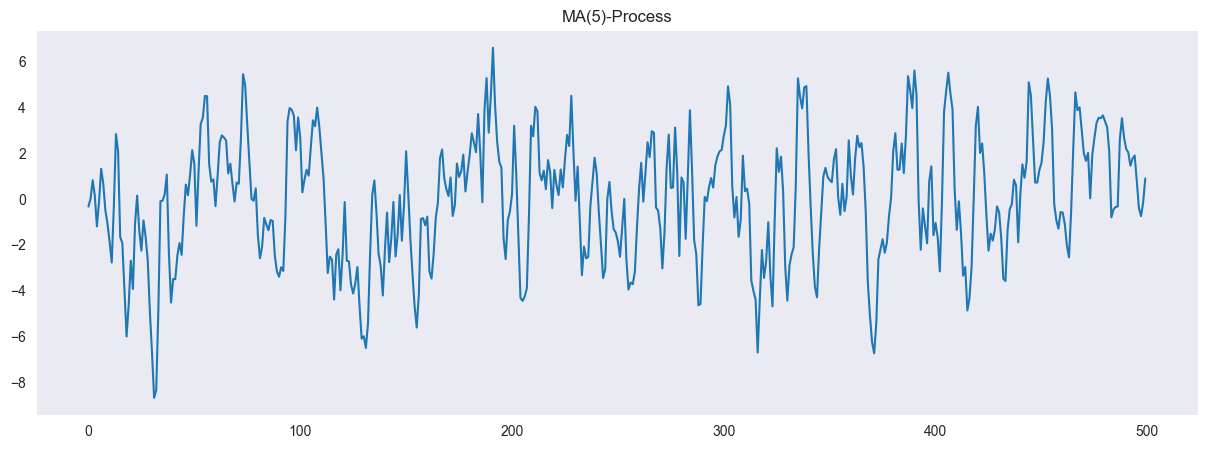

Moving average models can be used to model dependencies in the noise of a stochastic process. A moving average model of order (MA(q)-process) is defined as

is a white noise model with standard deviation . We now will generate an MA(4) Model. We consider the MA(4) process

Source

from statsmodels.tsa.arima_process import ArmaProcess

import matplotlib.pyplot as plt

ma4 = [1, 1.5, 1.1, 1, 0.9]

model = ArmaProcess(ar = None, ma = ma4)

simulated_data = model.generate_sample(nsample=500)

plt.figure(figsize = (15,5))

plt.plot(simulated_data, '-')

plt.grid()

plt.title("MA(5)-Process")

plt.show()

Moving average processes are always stationary but they are not unique in the sense that two different MA(q) processes can have the same autocorrelation function. Yet, there is always a unique process that is invertible. To check if a MA(q)-process is invertible we can investigate the roots of its characteristic polynomial

If all roots of have absolute value larger than 1, then the process is invertible.

We check this for our process using the model.isinvertible command:

model.isinvertibleFalseimport numpy as np

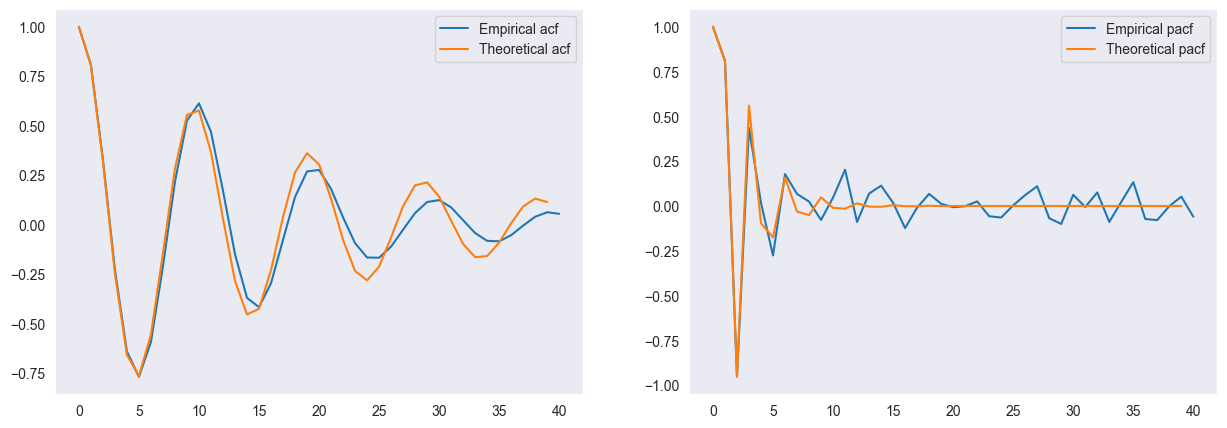

np.abs(model.maroots)array([0.92900679, 0.92900679, 1.13464461, 1.13464461])We finally compute the autocorrelation and partial autocorrelation for our process (again, the empirical and the theoretical version). The acf of a MA(q) process vanishes for lags larger than and the pacf oscillates.

Source

from statsmodels.tsa.stattools import acf, pacf

fig, ax = plt.subplots(1,2, figsize = (15,5))

ax[0].plot(acf(simulated_data, nlags=40), label = "empirical acf")

ax[0].plot(model.acf(lags=40), label = "theoretical acf")

ax[0].legend()

ax[0].grid()

ax[1].plot(pacf(simulated_data, nlags=40), label = "empirical pacf")

ax[1].plot(model.pacf(lags=40), label = "theoretical pacf")

ax[1].legend()

ax[1].grid()

ARMA Model: AR and MA¶

By combining autoregressive and moving average models we arrive at ARMA(p,q)-processes. They are formally defined as

where and are the characteristic polynomials of the autoregressive and moving average model respectively and is the backshift operator, i.e.

In particular, we have

and

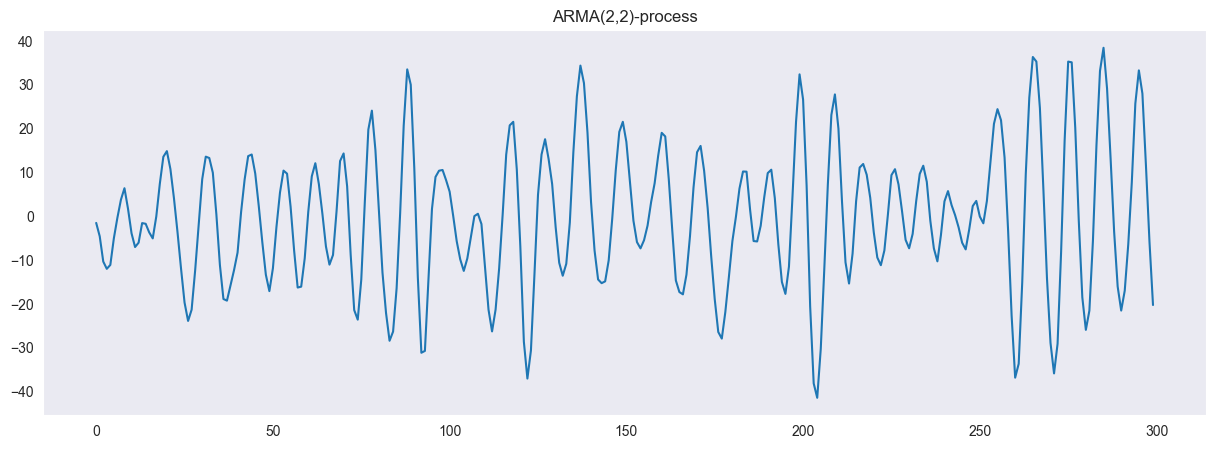

In the following, we will generate an AR(2,2) process. We define the ARMA(2,2) process as

We define the ARMA(2,2) process as

or

from statsmodels.tsa.arima_process import ArmaProcess

import matplotlib.pyplot as plt

ar2 = [1, -1.5, 0.9]

ma2 = [1, 1.5, 2.2]

model = ArmaProcess(ar = ar2, ma = ma2)

simulated_data = model.generate_sample(nsample=300)

plt.figure(figsize = (15,5))

plt.plot(simulated_data, '-')

plt.title("ARMA(2,2)-process")

plt.grid()

plt.show()

We can check the stationarity and causality of the model as with the pure AR(p) and MA(q) processes, i.w. via the roots of the repsective characteristic polynomials.

import numpy as np

print(model.isstationary)

print(np.abs(model.arroots))True

[1.05409255 1.05409255]

import numpy as np

print(model.isinvertible)

print(np.abs(model.maroots))False

[0.67419986 0.67419986]

The acf and pacf for an ARMA(p,q) model do not have any distinct cut-off behaviour that aids for model selection. We demonstrate this with the simulated data.

Source

from statsmodels.tsa.stattools import acf, pacf

fig, ax = plt.subplots(1,2, figsize = (15,5))

ax[0].plot(acf(simulated_data, nlags=40), label = "Empirical acf")

ax[0].plot(model.acf(lags=40), label = "Theoretical acf")

ax[0].legend()

ax[0].grid()

ax[1].plot(pacf(simulated_data, nlags=40), label = "Empirical pacf")

ax[1].plot(model.pacf(lags=40), label = "Theoretical pacf")

ax[1].legend()

ax[1].grid()

Estimating ARMA(p,q) from data¶

We are now given a time series and we want to estimate for a given order the coefficients and . We showed the maximum likelihood method as one approach (although there are different ways to estimate the coefficients)

from statsmodels.tsa.arima.model import ARIMA

import matplotlib.pyplot as plt

import pandas as pd

import numpy as np

df = pd.read_csv("data/TeslaIdx1.csv", sep ="\t")

df.head()We turn the data frame into a times series object

df['Date'] = pd.to_datetime(df['Date'])

df.set_index('Date', drop = True, inplace=True)

df.head()---------------------------------------------------------------------------

KeyError Traceback (most recent call last)

File ~/Development/marbetschar/notes/.venv/lib/python3.12/site-packages/pandas/core/indexes/base.py:3812, in Index.get_loc(self, key)

3811 try:

-> 3812 return self._engine.get_loc(casted_key)

3813 except KeyError as err:

File pandas/_libs/index.pyx:167, in pandas._libs.index.IndexEngine.get_loc()

File pandas/_libs/index.pyx:196, in pandas._libs.index.IndexEngine.get_loc()

File pandas/_libs/hashtable_class_helper.pxi:7088, in pandas._libs.hashtable.PyObjectHashTable.get_item()

File pandas/_libs/hashtable_class_helper.pxi:7096, in pandas._libs.hashtable.PyObjectHashTable.get_item()

KeyError: 'Date'

The above exception was the direct cause of the following exception:

KeyError Traceback (most recent call last)

Cell In[4], line 1

----> 1 df['Date'] = pd.to_datetime(df['Date'])

2 df.set_index('Date', drop = True, inplace=True)

3 df.head()

File ~/Development/marbetschar/notes/.venv/lib/python3.12/site-packages/pandas/core/frame.py:4113, in DataFrame.__getitem__(self, key)

4111 if self.columns.nlevels > 1:

4112 return self._getitem_multilevel(key)

-> 4113 indexer = self.columns.get_loc(key)

4114 if is_integer(indexer):

4115 indexer = [indexer]

File ~/Development/marbetschar/notes/.venv/lib/python3.12/site-packages/pandas/core/indexes/base.py:3819, in Index.get_loc(self, key)

3814 if isinstance(casted_key, slice) or (

3815 isinstance(casted_key, abc.Iterable)

3816 and any(isinstance(x, slice) for x in casted_key)

3817 ):

3818 raise InvalidIndexError(key)

-> 3819 raise KeyError(key) from err

3820 except TypeError:

3821 # If we have a listlike key, _check_indexing_error will raise

3822 # InvalidIndexError. Otherwise we fall through and re-raise

3823 # the TypeError.

3824 self._check_indexing_error(key)

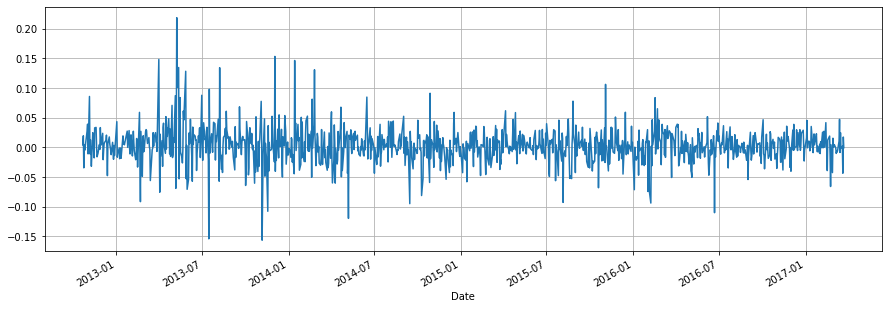

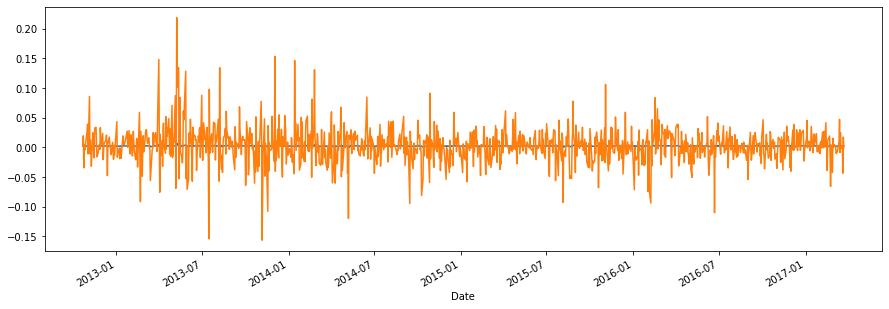

KeyError: 'Date'We compute the log-returns of the stock index for the closing value of the index, i.e.

lr = np.log(df.Close.values[1:]/df.Close.values[:-1])

lr = np.r_[np.NaN, lr]

df['LogRet'] = lr

df['LogRet'].plot(figsize = (15,5))

plt.grid()

We use the ARIMA class to estimate the parameters. To this end, we initialize the class with the observed series and the order of the model. By calling .fit() the model parameters are estimated. The summary function gives a comprehensive report on the model.

df.dropna(axis = 0, inplace = True)

model = ARIMA(df.LogRet, order = (1,0,1))

res = model.fit()

print(res.summary()) SARIMAX Results

==============================================================================

Dep. Variable: LogRet No. Observations: 1111

Model: ARIMA(1, 0, 1) Log Likelihood 2308.225

Date: Wed, 13 Dec 2023 AIC -4608.449

Time: 13:20:25 BIC -4588.397

Sample: 0 HQIC -4600.867

- 1111

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0020 0.001 2.111 0.035 0.000 0.004

ar.L1 -0.2060 0.864 -0.238 0.812 -1.899 1.487

ma.L1 0.2277 0.864 0.263 0.792 -1.467 1.922

sigma2 0.0009 2.01e-05 45.762 0.000 0.001 0.001

===================================================================================

Ljung-Box (L1) (Q): 0.00 Jarque-Bera (JB): 1953.04

Prob(Q): 0.99 Prob(JB): 0.00

Heteroskedasticity (H): 0.39 Skew: 0.49

Prob(H) (two-sided): 0.00 Kurtosis: 9.42

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

The summary shows that the estimated coefficients are not significantly different from 0 which means, that the time series can not be modelled by means of an AR(1,1) model. This is also the reason why you whitness different coefficients compared to the slides: Since there is no real model describing the log-returns of the Tesla stock index the estimated coefficients are just due to some numerical algorithm. Depending on the algorithm implementation you will receive other results.

The plot below showing the predicted values further stresses the fact that modelling of the log-returns is futile.

plt.figure(figsize = (15,5))

plt.plot(res.predict())

df.LogRet.plot()

Model selection for ARMA(p,q)¶

So far we did not bother about choosing the model order. However, this is a delicate task since the acf and pacf plots no longer help in this respect. Instead we will focus on the Akaike information criterion (AIC) as a goodness-of-fit measure that is comparable across various model dimensions. It is defined as

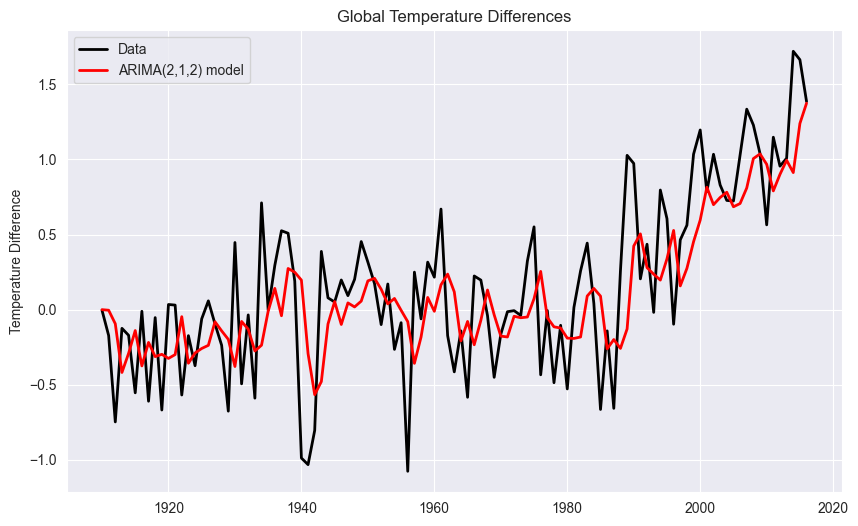

Here is the likelihood function of the problem and the vector of all unknown parameters in the model. The vector contains the time series data that we want to model. For a fitted model - let us choose arbitrarily the model ARIMA(2,1,2) - the AIC value can be retrieved.

from statsmodels.tsa.arima.model import ARIMA

import matplotlib.pyplot as plt

import pandas as pd

import numpy as np

import warnings

warnings.filterwarnings("ignore")

df = pd.read_csv("data/temperatures.csv")

df['Year'] = pd.to_datetime(df['Year'], format="%Y")

df.set_index('Year', drop = True, inplace=True)

df.dropna(axis = 0, inplace = True)

model = ARIMA(df.Value, order = (2,1,2))

res = model.fit()

print(res.aic)125.28563917508072

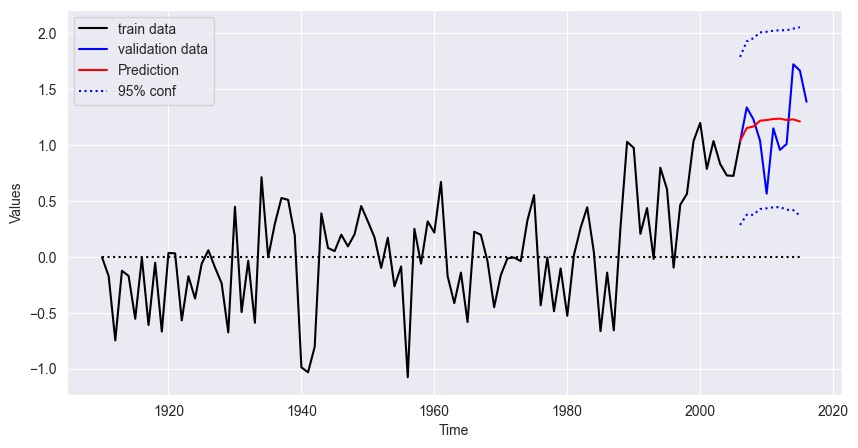

The model predictions look as follows:

# Plot the original data

temp = df['Value']

plt.figure(figsize=(10, 6))

plt.plot(temp, label='Data', color='black', linewidth=2)

plt.plot(temp - res.resid, label='ARIMA(2,1,2) model', color='red', linewidth=2)

plt.title("Global Temperature Differences")

plt.ylabel("Temperature Difference")

plt.legend()

plt.show()

How do we determine the differencing order and the order parameters for the AR(p) process and for the MA(q) process?

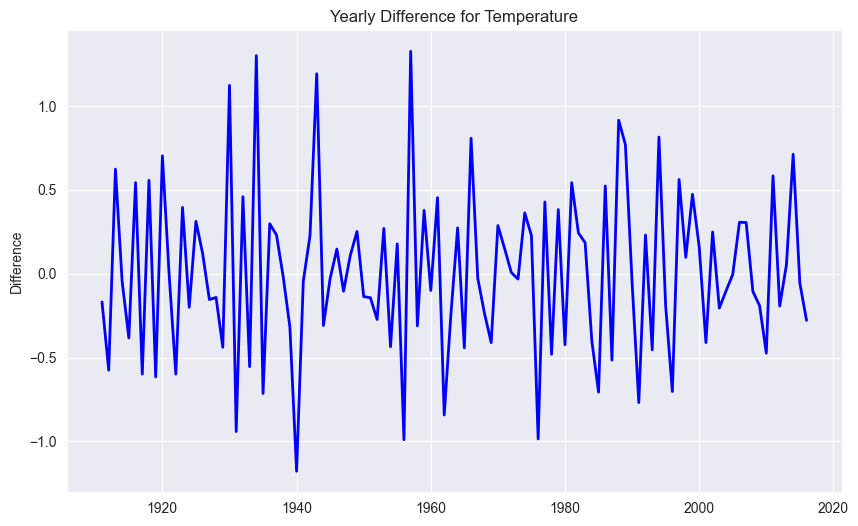

STEP 1 : Determine the Differencing Order d¶

We start with order , i.e., we compute the differences of the temperatures

# Extract the temperature column

temp = df['Value']

# Plot the first order difference

plt.figure(figsize=(10, 6))

plt.plot(temp.diff(), label='Yearly Difference', color='blue', linewidth=2)

plt.title("Yearly Difference for Temperature")

plt.ylabel("Difference")

plt.grid(True)

plt.show()

The trend is not any more visible. Thus, we choose as differencing order.

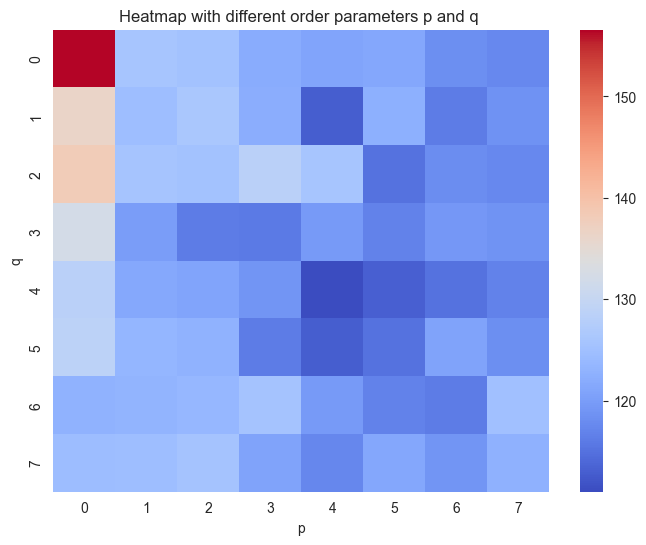

STEP 2 : Determine the Order Parameters p and q¶

We now simply loop over a range of candidate model and select the best model in terms of the lowest AIC value. This is a brute force method that is limited by the amount of candidate model that we consider.

from itertools import product

import seaborn as sns

import warnings

warnings.filterwarnings("ignore")

ar = np.arange(8)

ma = np.arange(8)

AIC = np.zeros((8,8))

for comb in product(ar, ma):

p = comb[0]

q = comb[1]

model = ARIMA(temp, order = (p,1,q))

res = model.fit()

AIC[p,q] = res.aic

plt.figure(figsize=(8, 6))

ax = sns.heatmap(AIC, cmap='coolwarm')

# Labeling

ax.set_xlabel('p')

ax.set_ylabel('q')

ax.set_title('Heatmap with different order parameters p and q ')

plt.show()

On the basis of the heatmap, we choose and which shows the lowest AIC value.

import numpy as np

import matplotlib.pyplot as plt

from statsmodels.tsa.arima.model import ARIMA

# Fit the ARIMA model

model_opt = ARIMA(temp["1910":"2006"], order=(4, 1, 4)).fit()

# Predict including confidence interval

pred = model_opt.get_prediction(start="2007", end="2016")

pred = pred.prediction_results

pred_cov = pred._forecasts_error_cov

pred = pred._forecasts[0]

pred_upper = pred + 1.96 * np.sqrt(pred_cov[0][0])

pred_lower = pred - 1.96 * np.sqrt(pred_cov[0][0])

# Plot

x = temp.index.year

x_pred = np.arange(2006, 2016)

fig = plt.figure(figsize=(10, 5))

ax = fig.add_subplot(1, 1, 1)

ax.plot(x[:97], temp["1910":"2006"], '-k', label='train data')

ax.plot(x[96:], temp["2006":"2016"], 'b', label='validation data')

ax.plot(x_pred, pred, 'r', label='Prediction')

ax.plot(x_pred, pred_upper, ':b', label='95% conf')

ax.plot(x_pred, pred_lower, ':b')

ax.plot([x[0], x_pred[-1]], [0, 0], ':k')

plt.xlabel("Time")

plt.ylabel("Values")

plt.legend()

plt.show()

Performance Metrics¶

MAE¶

# Actual values for the prediction period

observed_values = temp["2007":"2016"]

pred = model_opt.get_prediction(start="2007", end="2016")

pred = pred.prediction_results

predicted_values = pred._forecasts[0]

# Calculating MAE

mae = np.mean(np.abs(predicted_values - observed_values))

print("Mean Absolute Error (MAE):", mae)Mean Absolute Error (MAE): 0.28410908386305544

RMSE¶

# Calculating RMSE

rmse = np.sqrt(np.mean((predicted_values - observed_values) ** 2))

print("Root Mean Square Error (RMSE):", rmse)Root Mean Square Error (RMSE): 0.3373007497235178

MAPE¶

# Calculating MAPE

mape = np.mean(np.abs((observed_values - predicted_values) / observed_values)) * 100

print("Mean Absolute Percentage Error (MAPE):", mape, "%")Mean Absolute Percentage Error (MAPE): 28.186547936354867 %

Quartile Score¶

import scipy.stats as stats

# Forecast

forecast_length = len(predicted_values)

forecast_result = model_opt.get_forecast(steps=forecast_length)

forecast_mean = forecast_result.predicted_mean

forecast_std = np.sqrt(forecast_result.var_pred_mean)

# Function to compute quantile forecasts

def compute_quantile_forecasts(mean, std, quantiles):

forecasts = {}

for quantile in quantiles:

z_score = stats.norm.ppf(quantile)

forecasts[quantile] = mean + z_score * std

return forecasts

# Quantiles to compute

quantiles = [0.25, 0.5, 0.75]

# Compute quantile forecasts

quantile_forecasts = compute_quantile_forecasts(forecast_mean, forecast_std, quantiles)

# Function to calculate pinball loss

def pinball_loss(y_true, y_pred, quantile):

delta = y_true - y_pred

return np.mean(np.where(delta >= 0, quantile * delta, (quantile - 1) * delta))

# Calculate quartile scores for each quantile forecast

quartile_scores = {}

for quantile in quantiles:

quartile_scores[quantile] = pinball_loss(observed_values, quantile_forecasts[quantile], quantile)

# Display the quartile scores

for quantile, score in quartile_scores.items():

print(f"Quartile score for quantile {quantile}: {score}")Quartile score for quantile 0.25: 0.10999166116844598

Quartile score for quantile 0.5: 0.14205454193152772

Quartile score for quantile 0.75: 0.1068138721138264

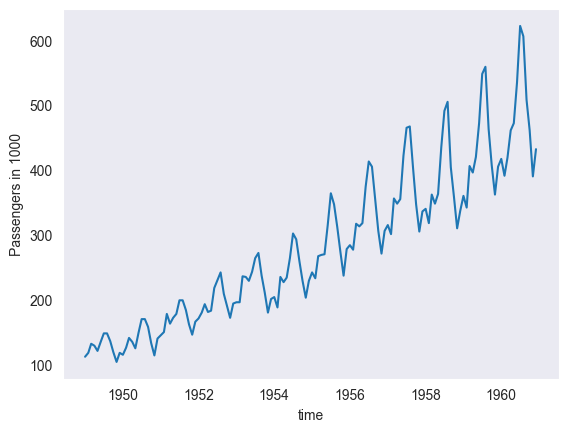

SARIMA Model¶

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

# loading data

AirP = pd.read_csv('data/AirPassengers.csv')

# creating pandas DateTimeIndex

dtindex = pd.DatetimeIndex(data = pd.to_datetime(AirP['TravelDate']), freq = 'infer')

# setting as Index

AirP.set_index(dtindex, inplace = True)

AirP.drop('TravelDate', axis = 1, inplace = True)

# plotting data

plt.plot(AirP)

plt.xlabel('time')

plt.ylabel('Passengers in 1000')

plt.grid()

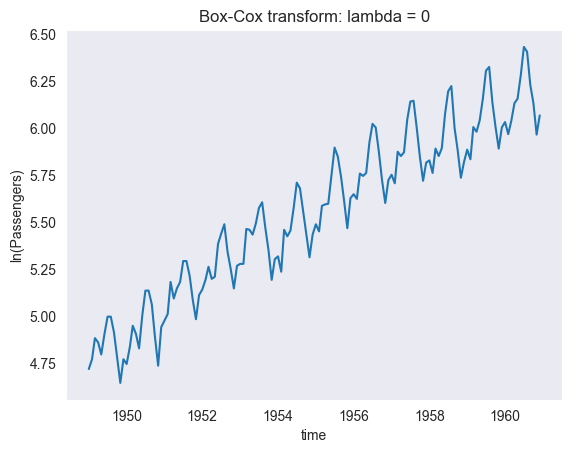

# STEP: transforming the data (for stationarity)

# --- there is an increasing variance -> let's "stabilize" the variance by transforming the data

# (with Box-Cox transform with lambda = 0, therefore just taking the log)

AirP_TRA = np.log(AirP['Passengers']) # TRA <-> transformed

# plotting

plt.plot(AirP_TRA)

plt.xlabel('time')

plt.ylabel('ln(Passengers)')

plt.title('Box-Cox transform: lambda = 0')

plt.grid()

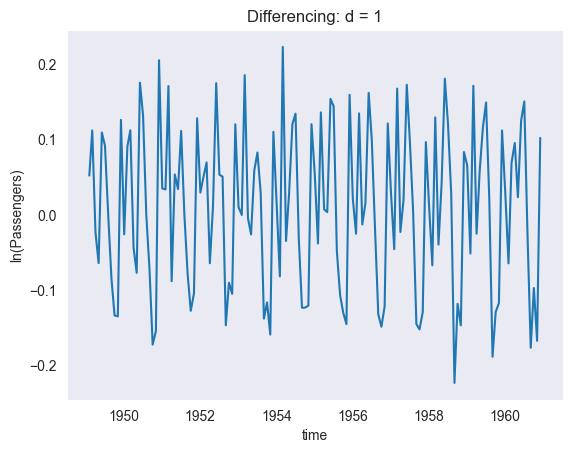

# --- there is a trend -> let's apply "differencing" to AirP_TRA

AirP_TRA_1 = AirP_TRA.diff()

# plotting

plt.plot(AirP_TRA_1)

plt.xlabel('time')

plt.ylabel('ln(Passengers)')

plt.title('Differencing: d = 1')

plt.grid()

# OK for d = 1

# --- there is seems to be a seasonality -> let's apply "differencing" for lag 12 to AirP_TRA_1

AirP_TRA_1_12 = AirP_TRA_1.diff(periods = 12)

# plotting

plt.plot(AirP_TRA_1_12)

plt.xlabel('time')

plt.ylabel('ln(Passengers)')

plt.title('Differencing: s = 12')

plt.grid()

# OK for s = 12

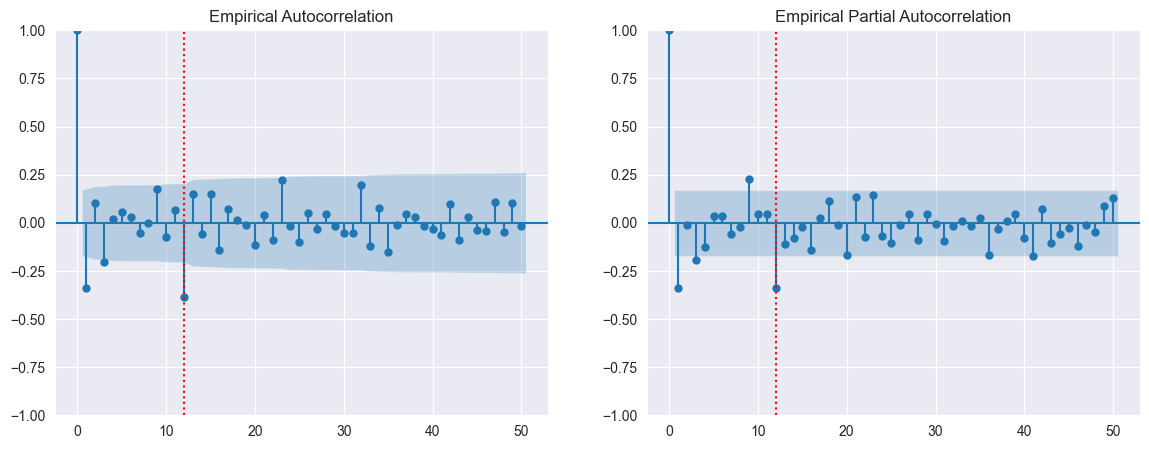

# STEP: determining the values of "order" parameters P and Q (seasonal)

# plotting the empirical autocorrelation (acf) and empirical partial autocorrelation (pacf)

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

fig = plt.figure(figsize = (14, 5))

ax1 = fig.add_subplot(1, 2, 1)

plot_acf(AirP_TRA_1_12.dropna(), lags = 50, ax = ax1, title = 'Empirical Autocorrelation')

ax1.plot([12, 12], [-1, 1], ':r')

ax2 = fig.add_subplot(1, 2, 2)

plot_pacf(AirP_TRA_1_12.dropna(), lags = 50, ax = ax2, title = 'Empirical Partial Autocorrelation')

ax2.plot([12, 12], [-1, 1], ':r')

# OK for P = 1 and Q = 1

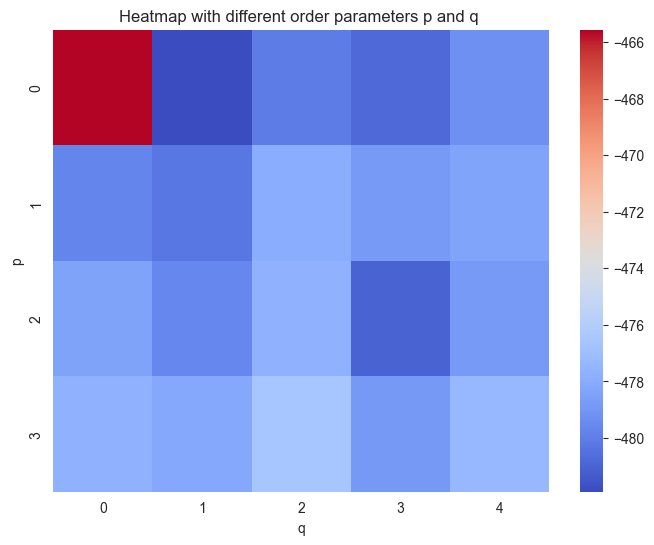

# STEP: determine the values of "order" parameters p and q (non-seasonal)

from statsmodels.tsa.arima.model import ARIMA

from itertools import product

import seaborn as sns

p = np.arange(4)

q = np.arange(5)

AIC = np.zeros((len(p), len(q)))

for comb in product(p, q):

p_ind = comb[0]

q_ind = comb[1]

model = ARIMA(AirP_TRA, order = (p_ind, 1, q_ind), seasonal_order = (1, 1, 1, 12))

res = model.fit()

AIC[p_ind, q_ind] = res.aic

# plotting heatmap

plt.figure(figsize = (8, 6))

ax = sns.heatmap(AIC, cmap = 'coolwarm')

ax.set_xlabel('q')

ax.set_ylabel('p')

ax.set_title('Heatmap with different order parameters p and q ')

plt.show()

# OK for p = 0 and q = 1

result = ARIMA(AirP_TRA, order = (0, 1, 1), seasonal_order = (1, 1, 1, 12)).fit()

result.aic

-481.9060733749852# STEP: forecasting

from statsmodels.tsa.arima.model import ARIMA

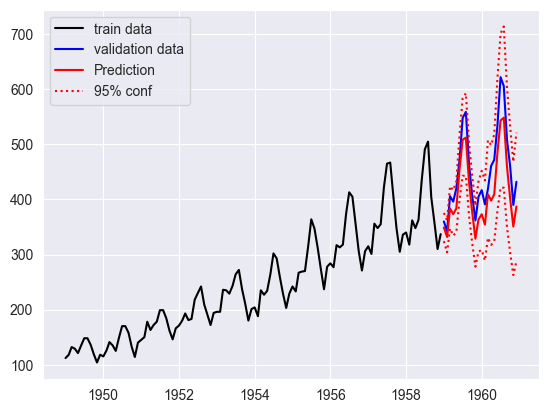

# fitting SARIMA model on data from 1949-01 to 1958-12

model_opt = ARIMA(AirP_TRA['1949':'1958'], order = (0, 1, 1), seasonal_order = (1, 1, 1, 12)).fit()

# computing predictions (including confidence interval)

pred = model_opt.get_prediction(start = '1959-01-01', end = '1960-12-01')

pred = pred.prediction_results

pred_cov = pred._forecasts_error_cov

pred = pred._forecasts[0]

pred_upper = pred + 1.96 * np.sqrt(pred_cov[0][0])

pred_lower = pred - 1.96 * np.sqrt(pred_cov[0][0])

# plotting results in original variables (i.e. after inverse Box-Cox)

# time interval for prediction

t_pred = AirP_TRA['1959':'1960'].index

plt.plot(AirP['1949':'1958'], '-k', label = 'train data')

plt.plot(AirP['1959':'1960'], 'b', label = 'validation data')

plt.plot(t_pred, np.exp(pred), 'r', label = 'Prediction')

plt.plot(t_pred, np.exp(pred_upper), ':r', label = '95% conf')

plt.plot(t_pred, np.exp(pred_lower), ':r')

plt.legend()

plt.show()